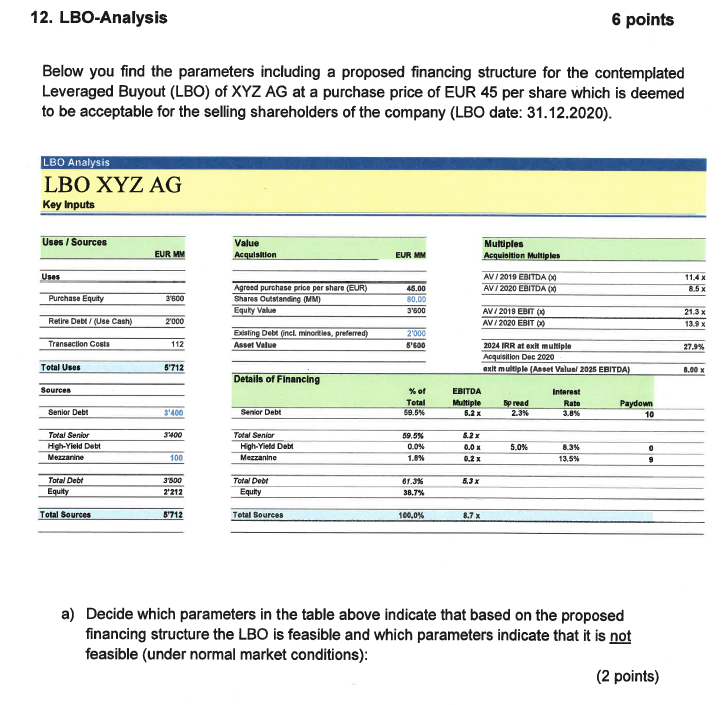

Question: Below you find the parameters including a proposed financing structure for the contemplated Leveraged Buyout (LBO) of XYZAG at a purchase price of EUR 45

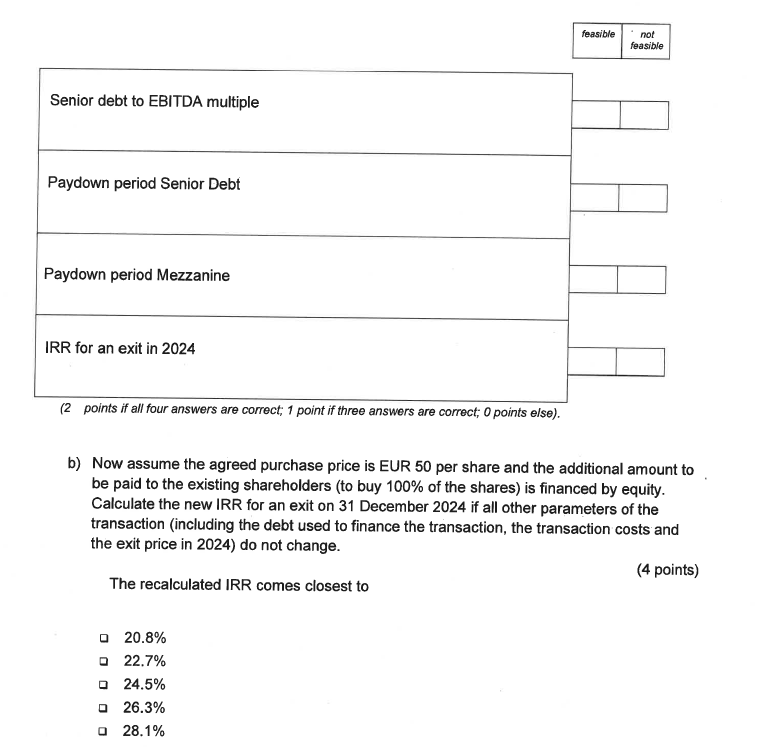

Below you find the parameters including a proposed financing structure for the contemplated Leveraged Buyout (LBO) of XYZAG at a purchase price of EUR 45 per share which is deemed to be acceptable for the selling shareholders of the company (LBO date: 31.12.2020). LBO Analysis LBO XYZ AG Key inputs a) Decide which parameters in the table above indicate that based on the proposed financing structure the LBO is feasible and which parameters indicate that it is not feasible (under normal market conditions): b) Now assume the agreed purchase price is EUR 50 per share and the additional amount to be paid to the existing shareholders (to buy 100% of the shares) is financed by equity. Calculate the new IRR for an exit on 31 December 2024 if all other parameters of the transaction (including the debt used to finance the transaction, the transaction costs and the exit price in 2024) do not change. The recalculated IRR comes closest to (4 points) 20.8% 22.7% - 24.5% 26.3% 28.1% Below you find the parameters including a proposed financing structure for the contemplated Leveraged Buyout (LBO) of XYZAG at a purchase price of EUR 45 per share which is deemed to be acceptable for the selling shareholders of the company (LBO date: 31.12.2020). LBO Analysis LBO XYZ AG Key inputs a) Decide which parameters in the table above indicate that based on the proposed financing structure the LBO is feasible and which parameters indicate that it is not feasible (under normal market conditions): b) Now assume the agreed purchase price is EUR 50 per share and the additional amount to be paid to the existing shareholders (to buy 100% of the shares) is financed by equity. Calculate the new IRR for an exit on 31 December 2024 if all other parameters of the transaction (including the debt used to finance the transaction, the transaction costs and the exit price in 2024) do not change. The recalculated IRR comes closest to (4 points) 20.8% 22.7% - 24.5% 26.3% 28.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts