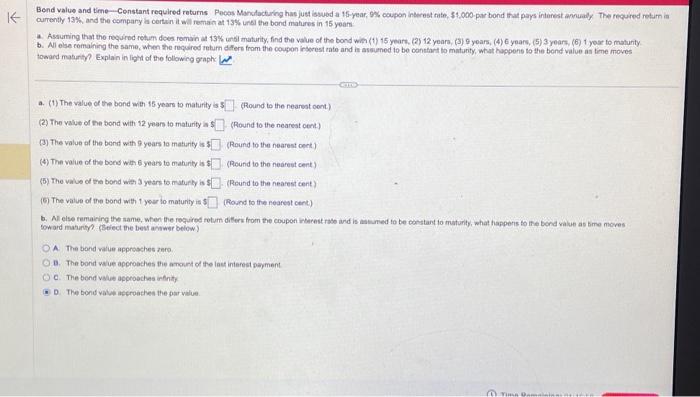

Question: Bend value and time - Constant required returns Pooes Mandecturing has just iswuod a 15 -year, 9% coupon interest rate, $1,000-par bond that pars intarest

Bend value and time - Constant required returns Pooes Mandecturing has just iswuod a 15 -year, 9% coupon interest rate, $1,000-par bond that pars intarest annualy The requred retum in curently 13%, and the compary la cortain it will remain at 13% unsi the bond matures in 15 yoan: a. Assuming that the required retum does romain at 13% unsi maturity, find the value of the bond wim (1) 15 years, (2) 12 years, (3) 9 yoars, (4) 6 years, (5) 3 years, (6) 1 yose to motunty, toward maturty? Explain in light of the following graph: a. (1) The value of the bond with 15 years to maturity is 4 (Round to the nearest oont) (2) The value of the bond with 12 years to maturity ia? (Round to the neareat cent) (3) The value of the bend with 9 years to matunty is 5 (Round to the nearest cect) (4) The value of the boed with 6 years to mahinty is $ (Round to the nearest cent) (5) The value of the bond with 3 years to muturly is? (Reund to the nearest cent) (6) The value of the bond with 1 yeur to maturity is s (Round to the nearest cent) A. The bond value approsches zero 8. The bonit value approaches the amount of the last interest payment c. The bond value approaches inthity D. The bond value accroathes the par vilue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts