Question: Bond value and Time Constant required returns Pecos Manufacturing has just issued a 15-year, 9% coupon interest rate, $1,000-par bond that pays interest annually. The

Bond value and Time Constant required returns Pecos Manufacturing has just issued a 15-year, 9% coupon interest rate, $1,000-par bond that pays interest annually. The required return is currently 11%, and the company is certain it will remain at 11% until the bond matures in 15 years.

a.Assuming that the required return does remain at 11% until maturity, find the value of the bond with (1) 15 years, (2) 12 years, (3) 9 years, (4) 6 years, (5) years, (6) 1 year to maturity.

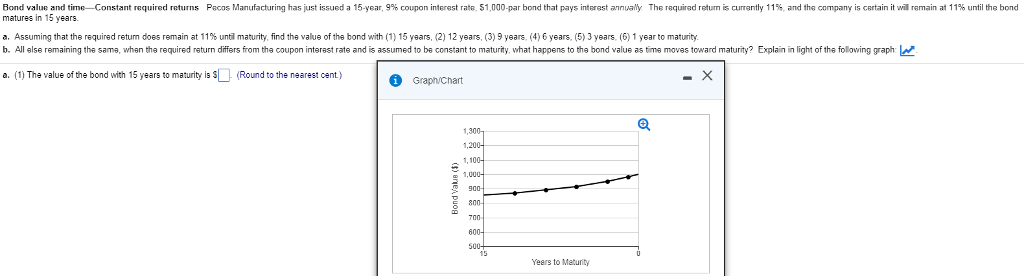

b.All else remaining the same, when the required return differs from the coupon interest rate and is assumed to be constant to maturity, what happens to the bond value as time moves toward maturity? Explain in light of the following graph:

ond value and time onstant required returns Pecos Manufacturing has ust issued a 15-year 9% coupon interest rate $1 00-par bond that pays l rest annu The required r um lS currently 11% and the company is certain remain a 11 until he bond matures in 15 years. a. Assuming that the required retum does remain at 11 % until maturity find the value of the bond with (1) 15 years (2) 12 years (3) 9 years (4) 6 years 5) 3 years (6) 1 year to maturity. b. All else remaining the sama, when tha required return differs from the coupon interest rate and is assumed to be constant to maturity, what happens to the bond value as time moves toward maturity? Explain in light of the following graph a. (1) The valueof the bond with 15 years to maturity iound to the nearest cent.) Graph/Chart Years to Maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts