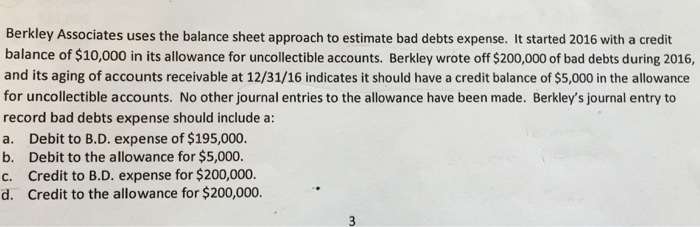

Question: Berkeley's journal entry to record bad debts expense should include a: Berkley Associates uses the balance sheet approach to estimate bad debts expense. It started

Berkley Associates uses the balance sheet approach to estimate bad debts expense. It started 2016 with a credit balance of $10,000 in its allowance for uncollectible accounts. Berkley wrote off $200,000 of bad debts during 2016, and its aging of accounts receivable at 12/31/16 indicates it should have a credit balance of $5,000 in the allowance for uncollectible accounts. No other journal entries to the allowance have been made. Berkley's journal entry to record bad debts expense should include a: Debit to B.D. expense of $195,000. Debit to the allowance for $5,000. Credit to B.D. expense for $200,000. Credit to the allowance for $200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts