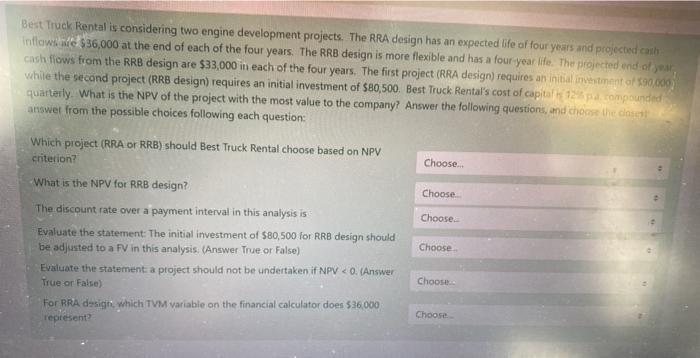

Question: Best Truck Rental is considering two engine development projects. The RRA design has an expected life of four years and projected cash inflows de $36,000

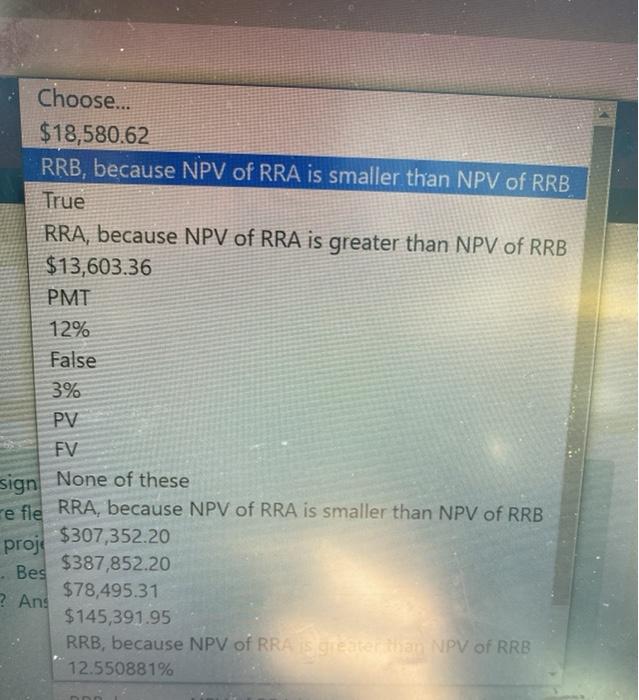

Best Truck Rental is considering two engine development projects. The RRA design has an expected life of four years and projected cash inflows de $36,000 at the end of each of the four years. The RRB design is more flexible and has a four year life. The projected and of cash flows from the RRB design are $33,000 in each of the four years. The first project (RRA design) requires an initial investment or $90,000 while the second project (RRB design) requires an initial investment of $80,500. Best Truck Rental's cost of capital 12 compounded quarterly. What is the NPV of the project with the most value to the company? Answer the following questions, and choose the answet from the possible choices following each question: Which project (RRA Or RRB) should Best Truck Rental choose based on NPV criterion? Choose. What is the NPV for RRB design? Choose Choose Choose The discount rate over a payment interval in this analysis is Evaluate the statement: The initial investment of $80,500 for RRB design should be adjusted to a FV in this analysis. (Answer True or False) Evaluate the statement a project should not be undertaken if NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts