Question: - Beta = 1.7 - Required return on debt (yield to maturity on a long term bond) = 3.1% - Tax rate = 21% -

| - Beta = 1.7 |

| - Required return on debt (yield to maturity on a long term bond) = 3.1% |

| - Tax rate = 21% |

| - 30-year government bond = 2.3% |

| - Market risk premium can be assumed to be 5% |

Calculate WACC?

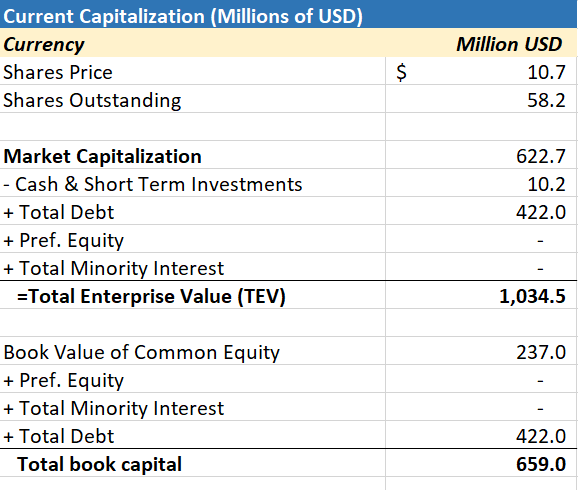

Current Capitalization (Millions of USD) Currency Shares Price Shares Outstanding $ Million USD 10.7 58.2 622.7 10.2 422.0 Market Capitalization - Cash & Short Term Investments + Total Debt + Pref. Equity + Total Minority Interest =Total Enterprise Value (TEV) 1,034.5 237.0 Book Value of Common Equity + Pref. Equity + Total Minority Interest + Total Debt Total book capital 422.0 659.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts