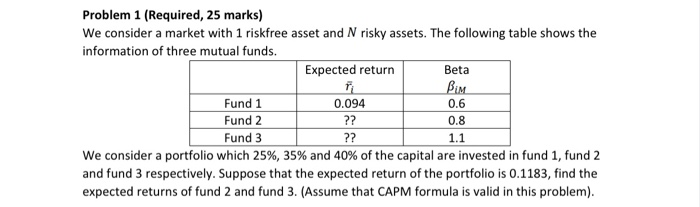

Question: Beta Problem 1 (Required, 25 marks) We consider a market with 1 riskfree asset and N risky assets. The following table shows the information of

Beta Problem 1 (Required, 25 marks) We consider a market with 1 riskfree asset and N risky assets. The following table shows the information of three mutual funds. Expected return Fi Bi Fund 1 0.094 0.6 Fund 2 ?? 0.8 Fund 3 ?? 1.1 We consider a portfolio which 25%, 35% and 40% of the capital are invested in fund 1, fund 2 and fund 3 respectively. Suppose that the expected return of the portfolio is 0.1183, find the expected returns of fund 2 and fund 3. (Assume that CAPM formula is valid in this problem)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts