Question: Beta & SML Problems Find the word in the bank below to fill in each blank. One word is used twice and one isn't used

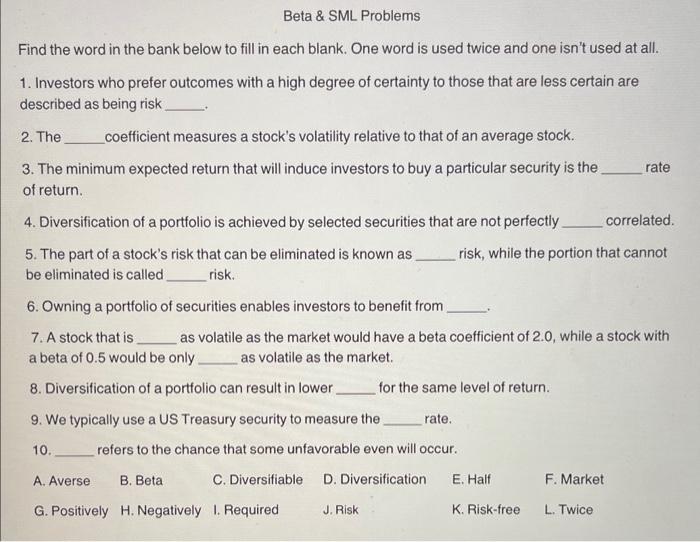

Beta \& SML Problems Find the word in the bank below to fill in each blank. One word is used twice and one isn't used at all. 1. Investors who prefer outcomes with a high degree of certainty to those that are less certain are described as being risk 2. The coefficient measures a stock's volatility relative to that of an average stock. 3. The minimum expected return that will induce investors to buy a particular security is the rate of return. 4. Diversification of a portfolio is achieved by selected securities that are not perfectly correlated. 5. The part of a stock's risk that can be eliminated is known as risk, while the portion that cannot be eliminated is called risk. 6. Owning a portfolio of securities enables investors to benefit from 7. A stock that is as volatile as the market would have a beta coefficient of 2.0 , while a stock with a beta of 0.5 would be only as volatile as the market. 8. Diversification of a portfolio can result in lower for the same level of return. 9. We typically use a US Treasury security to measure the rate. 10. refers to the chance that some unfavorable even will occur. A. Averse B. Beta C. Diversifiable D. Diversification E. Half F. Market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts