Question: Betas Look at the picture comparing the 5-year returns for Tesla (TSLA) and S&P 500 (^GSPC). It's obvious that the return volatility (i.e. standard deviation)

Betas

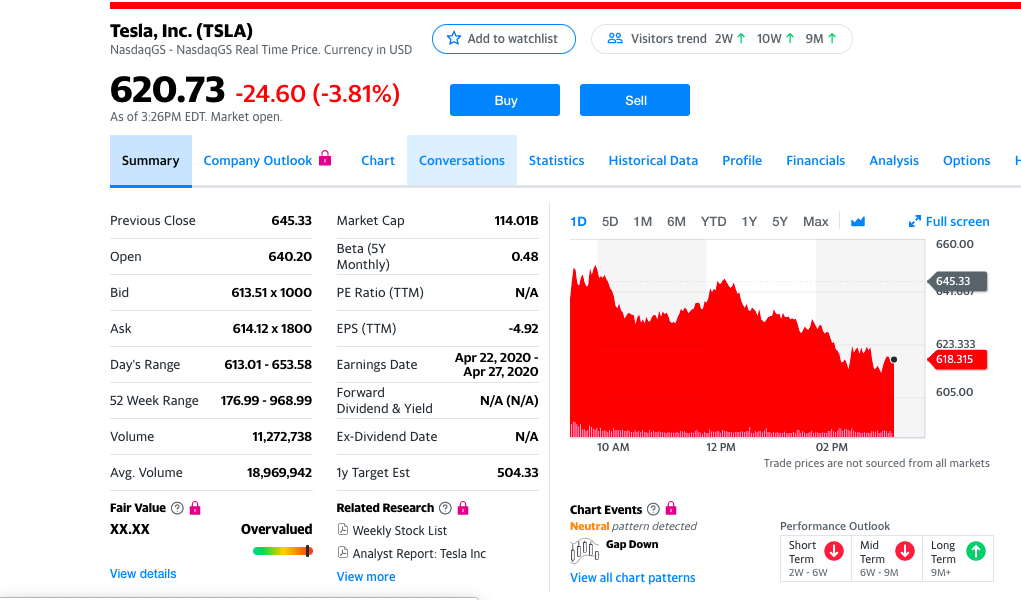

- Look at the picture comparing the 5-year returns for Tesla (TSLA) and S&P 500 (^GSPC). It's obvious that the return volatility (i.e. standard deviation) of Tesla stock is at least 3-5 times greater than that of the S&P 500 (the blue line). Yet, if you look up Tesla's 5 year beta (on the summary page of Yahoo Finance provided) is much less than one (around 0.5) suggesting that TSLA is much LESS volatile than the market.

- How do you explain this discrepancy between what standard deviation tells you (that TSLA is extremely risky and fluctuates a lot) and what beta tells you (that the stock is almost 40% SAFER than the overall market (SP500)?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock