Question: Beth (26, single) is reassessing her financial position having just completed her first year of full-time work after completing her post-graduate studies. Apart from

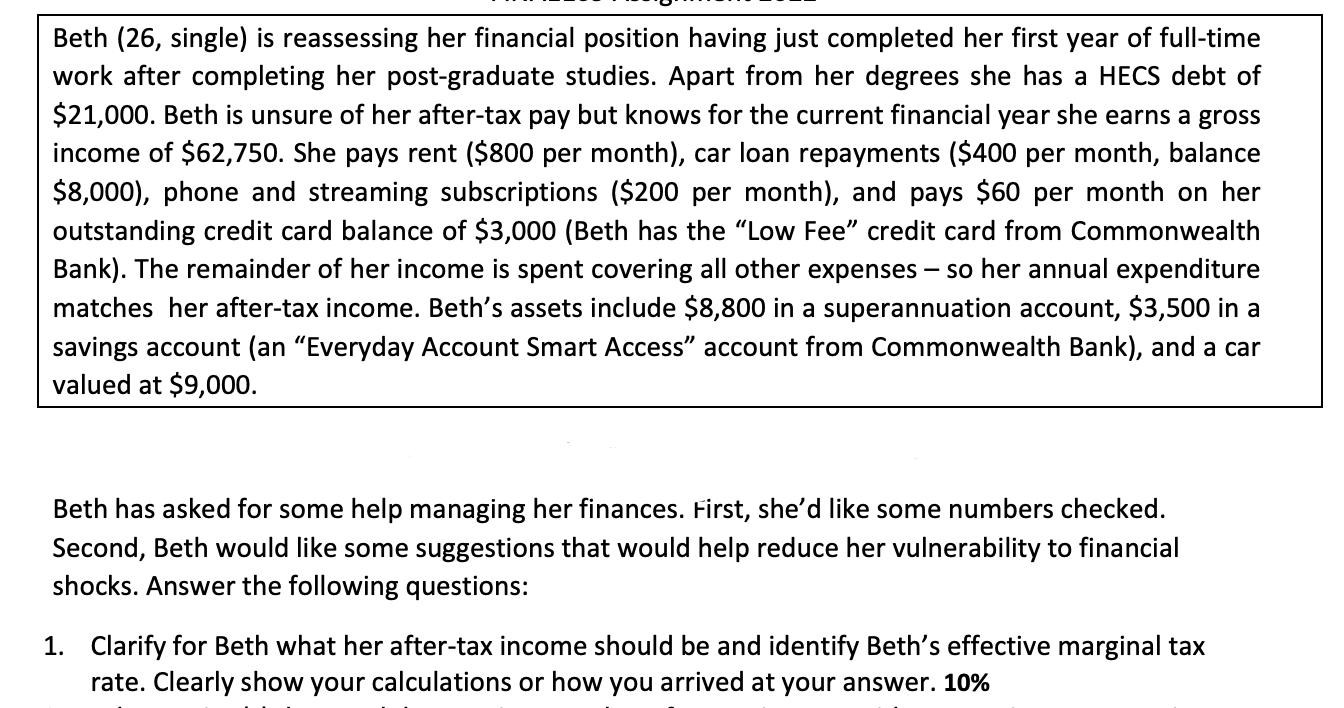

Beth (26, single) is reassessing her financial position having just completed her first year of full-time work after completing her post-graduate studies. Apart from her degrees she has a HECS debt of $21,000. Beth is unsure of her after-tax pay but knows for the current financial year she earns a gross income of $62,750. She pays rent ($800 per month), car loan repayments ($400 per month, balance $8,000), phone and streaming subscriptions ($200 per month), and pays $60 per month on her outstanding credit card balance of $3,000 (Beth has the "Low Fee" credit card from Commonwealth Bank). The remainder of her income is spent covering all other expenses - so her annual expenditure matches her after-tax income. Beth's assets include $8,800 in a superannuation account, $3,500 in a savings account (an "Everyday Account Smart Access" account from Commonwealth Bank), and a car valued at $9,000. Beth has asked for some help managing her finances. First, she'd like some numbers checked. Second, Beth would like some suggestions that would help reduce her vulnerability to financial shocks. Answer the following questions: 1. Clarify for Beth what her after-tax income should be and identify Beth's effective marginal tax rate. Clearly show your calculations or how you arrived at your answer. 10%

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Aftertax income 62750 62750 x 10 56475 Effective Marginal Tax Rate 10 ... View full answer

Get step-by-step solutions from verified subject matter experts