Question: BFA 103 Accounting & Financial Decision Making Question 1 The following information relates to Trills and Frills, a small sole trader that specialises in equipment

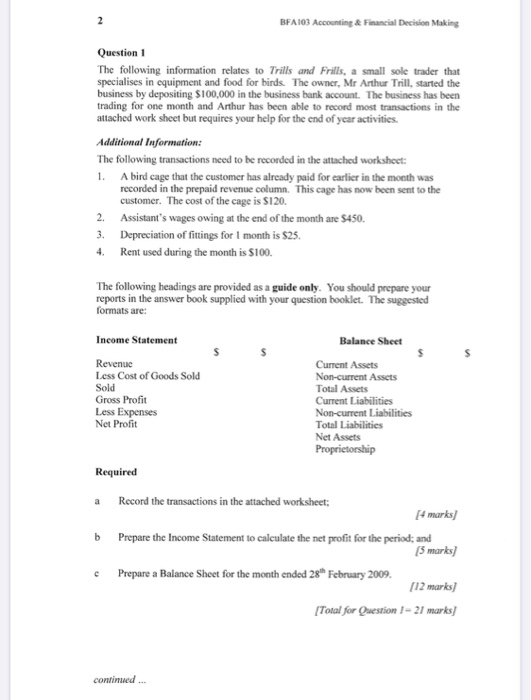

BFA 103 Accounting & Financial Decision Making Question 1 The following information relates to Trills and Frills, a small sole trader that specialises in equipment and food for birds. The owner, Mr Arthur Trill, started the business by depositing $100,000 in the business bank account. The business has been trading for one month and Arthur has been able to record most transactions in the attached work sheet but requires your help for the end of year activities. Additional Information: The following transactions need to be recorded in the attached worksheet: 1. A bird cage that the customer has already paid for earlier in the month was recorded in the prepaid revenue column. This cage has now been sent to the customer. The cost of the cage is $120. 2. Assistant's wages owing at the end of the month are $450. 3. Depreciation of fittings for 1 month is $25. 4. Rent used during the month is $100. The following headings are provided as a guide only. You should prepare your reports in the answer book supplied with your question booklet. The suggested formats are: $ Income Statement Revenue Less Cost of Goods Sold Sold Gross Profit Less Expenses Net Profit Balance Sheet Current Assets Non-current Assets Total Assets Current Liabilities Non-current Liabilities Total Liabilities et Assets Proprietorship Required a Record the transactions in the attached worksheet; [4 marks] b Prepare the Income Statement to calculate the net profit for the period; and [3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts