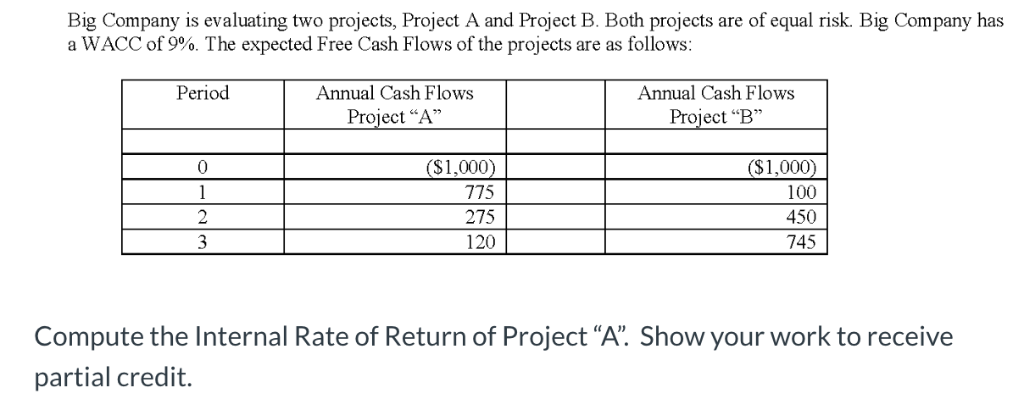

Question: Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 9%. The

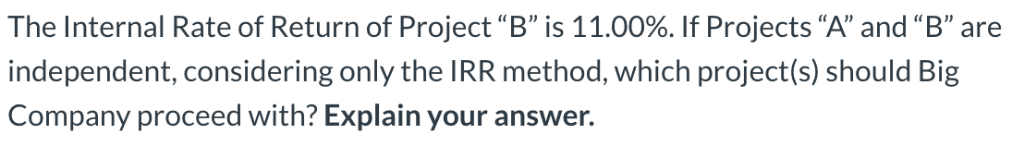

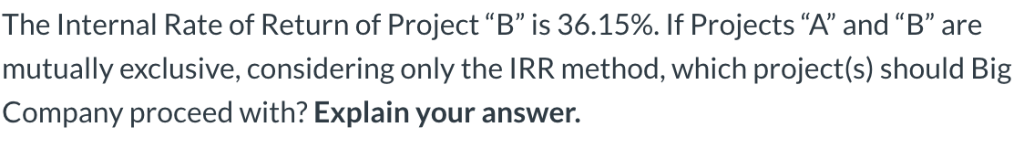

Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 9%. The expected Free Cash Flows of the projects are as follows: Period Annual Cash Flows Annual Cash Flows Project "A" Project "B* ($1,000) ($1,000) 1 775 100 450 275 3 120 745 Compute the Internal Rate of Return of Project "A". Show your work to receive partial credit. The Internal Rate of Return of Project "B" is 11.00%. If Projects "A" and "B" are independent, considering only the IRR method, which project(s) should Big Company proceed with? Explain your answer. The Internal Rate of Return of Project "B" is 36.15%. If Projects "A" and "B" are mutually exclusive, considering only the IRR method, which project(s) should Big Company proceed with? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts