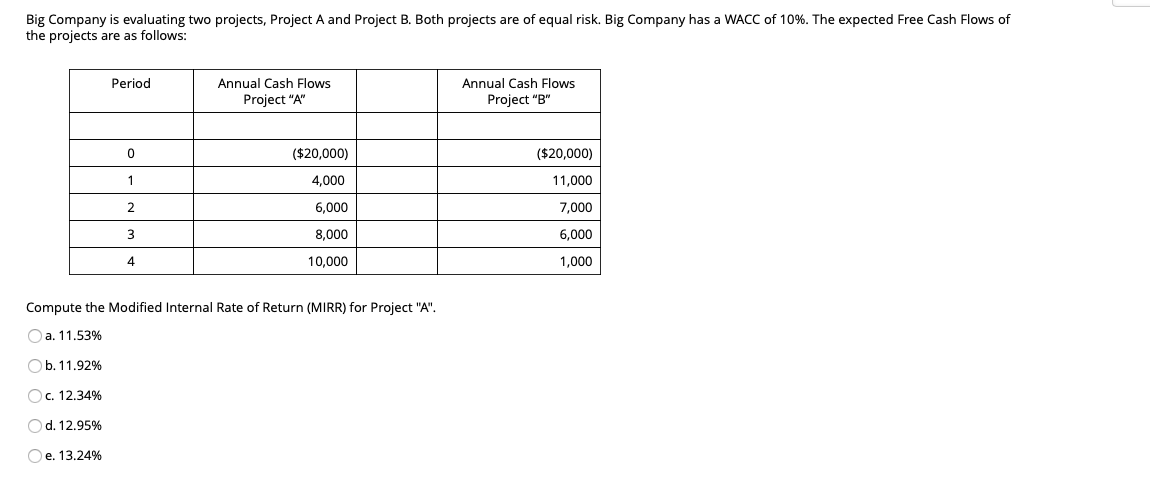

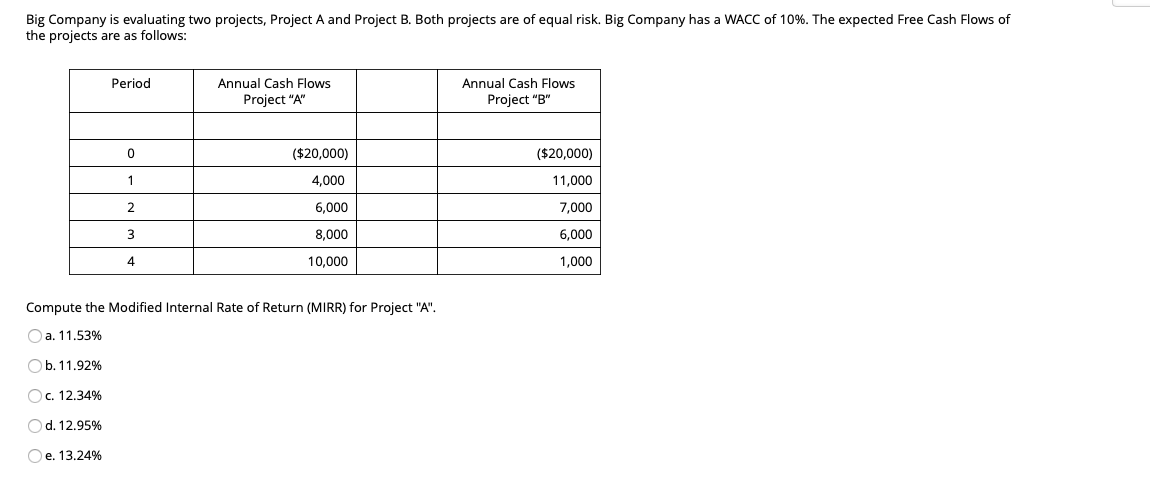

Question: Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The

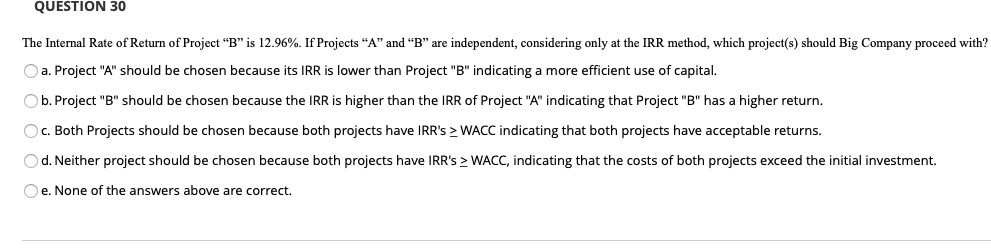

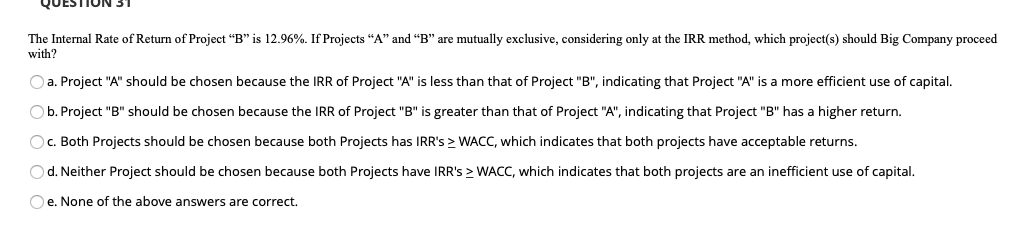

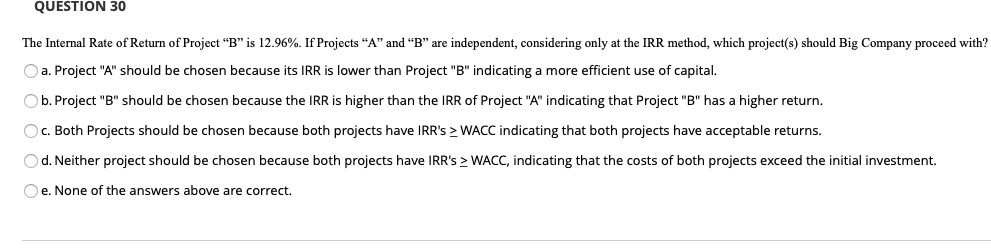

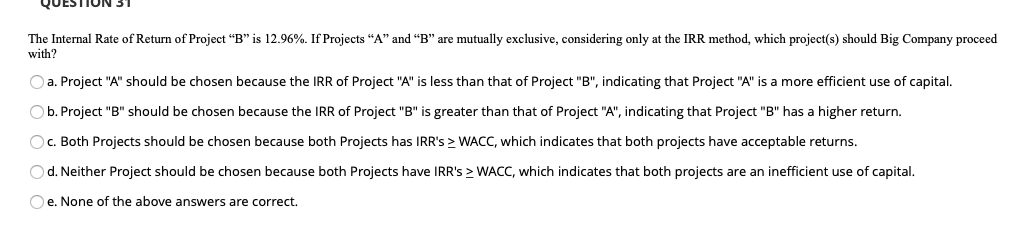

Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The expected Free Cash Flows of the projects are as follows: Period Annual Cash Flows Project "A" Annual Cash Flows Project "B" 0 ($20,000) ($20,000) 4,000 6,000 2 11,000 7,000 6,000 8,000 10,000 1,000 Compute the Modified Internal Rate of Return (MIRR) for Project "A". a. 11.53% b. 11.92% c. 12.34% Od. 12.95% e. 13.24% QUESTION 30 The Internal Rate of Return of Project "B" is 12.96%. If Projects "A" and "B" are independent, considering only at the IRR method, which project(s) should Big Company proceed with? a. Project "A" should be chosen because its IRR is lower than Project "B" indicating a more efficient use of capital. b. Project "B" should be chosen because the IRR is higher than the IRR of Project "A" indicating that Project "B" has a higher return. O c. Both Projects should be chosen because both projects have IRR's > WACC indicating that both projects have acceptable returns. Od. Neither project should be chosen because both projects have IRR's > WACC, indicating that the costs of both projects exceed the initial investment. e. None of the answers above are correct. QUESTIUN 31 The Internal Rate of Return of Project "B" is 12.96%. If Projects "A" and "B" are mutually exclusive, considering only at the IRR method, which project(s) should Big Company proceed with? a. Project "A" should be chosen because the IRR of Project "A" is less than that of Project "B", indicating that Project "A" is a more efficient use of capital. b. Project "B" should be chosen because the IRR of Project "B" is greater than that of Project "A", indicating that Project "B" has a higher return. c. Both Projects should be chosen because both Projects has IRR's > WACC, which indicates that both projects have acceptable returns. d. Neither Project should be chosen because both Projects have IRR's > WACC, which indicates that both projects are an inefficient use of capital. e. None of the above answers are correct. Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The expected Free Cash Flows of the projects are as follows: Period Annual Cash Flows Project "A" Annual Cash Flows Project "B" 0 ($20,000) ($20,000) 4,000 6,000 2 11,000 7,000 6,000 8,000 10,000 1,000 Compute the Modified Internal Rate of Return (MIRR) for Project "A". a. 11.53% b. 11.92% c. 12.34% Od. 12.95% e. 13.24% QUESTION 30 The Internal Rate of Return of Project "B" is 12.96%. If Projects "A" and "B" are independent, considering only at the IRR method, which project(s) should Big Company proceed with? a. Project "A" should be chosen because its IRR is lower than Project "B" indicating a more efficient use of capital. b. Project "B" should be chosen because the IRR is higher than the IRR of Project "A" indicating that Project "B" has a higher return. O c. Both Projects should be chosen because both projects have IRR's > WACC indicating that both projects have acceptable returns. Od. Neither project should be chosen because both projects have IRR's > WACC, indicating that the costs of both projects exceed the initial investment. e. None of the answers above are correct. QUESTIUN 31 The Internal Rate of Return of Project "B" is 12.96%. If Projects "A" and "B" are mutually exclusive, considering only at the IRR method, which project(s) should Big Company proceed with? a. Project "A" should be chosen because the IRR of Project "A" is less than that of Project "B", indicating that Project "A" is a more efficient use of capital. b. Project "B" should be chosen because the IRR of Project "B" is greater than that of Project "A", indicating that Project "B" has a higher return. c. Both Projects should be chosen because both Projects has IRR's > WACC, which indicates that both projects have acceptable returns. d. Neither Project should be chosen because both Projects have IRR's > WACC, which indicates that both projects are an inefficient use of capital. e. None of the above answers are correct