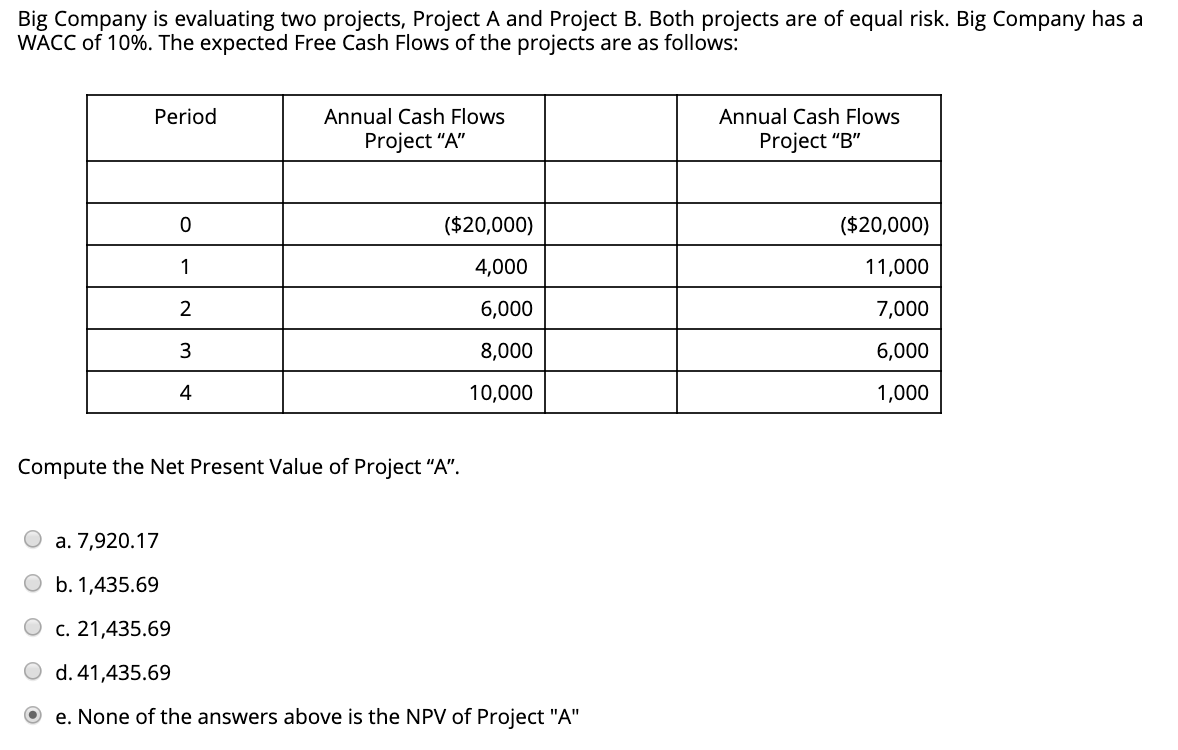

Question: Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The

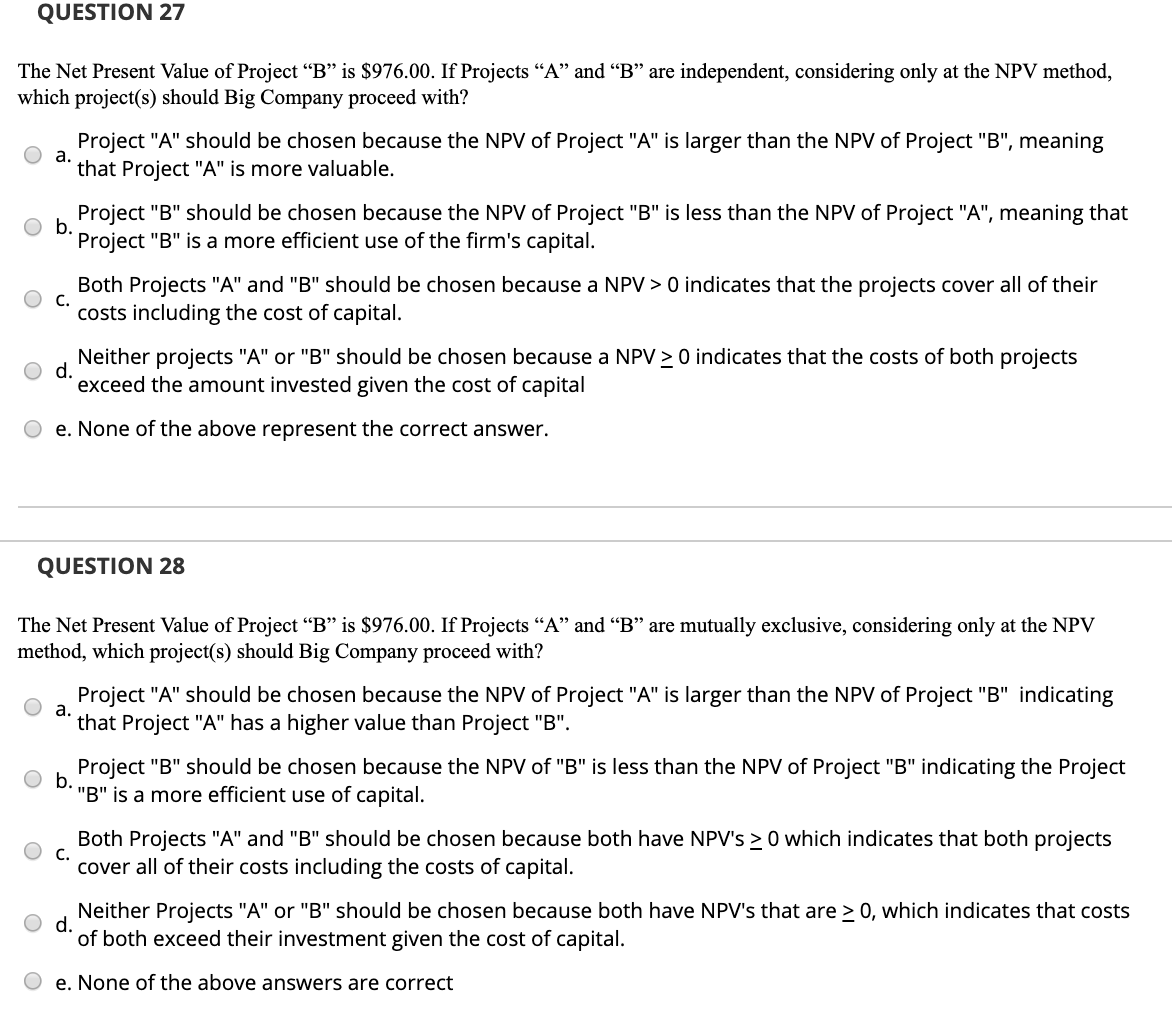

Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The expected Free Cash Flows of the projects are as follows: Period Annual Cash Flows Project "A" Annual Cash Flows Project "B" ($20,000) ($20,000) 4,000 11,000 6,000 7,000 8,000 6,000 10,000 1,000 Compute the Net Present Value of Project "A". O a. 7,920.17 O b. 1,435.69 O c. 21,435.69 O d. 41,435.69 e. None of the answers above is the NPV of Project "A" QUESTION 27 The Net Present Value of Project B is $976.00. If Projects A and B are independent, considering only at the NPV method, which project(s) should Big Company proceed with? Project "A" should be chosen because the NPV of Project "A" is larger than the NPV of Project "B", meaning that Project "A" is more valuable. Project "B" should be chosen because the NPV of Project "B" is less than the NPV of Project "A", meaning that Project "B" is a more efficient use of the firm's capital. Both Projects "A" and "B" should be chosen because a NPV > O indicates that the projects cover all of their costs including the cost of capital. O d. Neither Neither projects "A" or "B" should be chosen because a NPV > O indicates that the costs of both projects exceed the amount invested given the cost of capital O e. None of the above represent the correct answer. QUESTION 28 The Net Present Value of Project B is $976.00. If Projects A and B are mutually exclusive, considering only at the NPV method, which project(s) should Big Company proceed with? Project "A" should be chosen because the NPV of Project "A" is larger than the NPV of Project "B" indicating that Project "A" has a higher value than Project "B". Project "B" should be chosen because the NPV of "B" is less than the NPV of Project "B" indicating the Project O b. "B" is a more efficient use of capital. Both Projects "A" and "B" should be chosen because both have NPV'S > 0 which indicates that both projects cover all of their costs including the costs of capital. Neither Projects "A" or "B" should be chosen because both have NPV's that are > 0, which indicates that costs of both exceed their investment given the cost of capital. O e. None of the above answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts