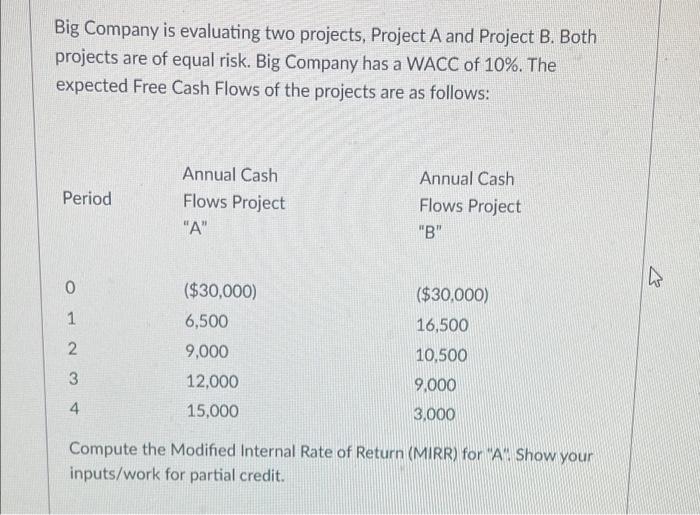

Question: Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The

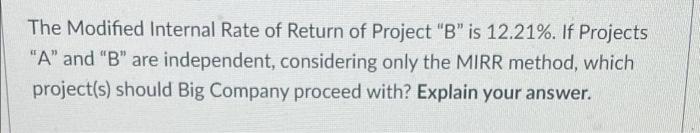

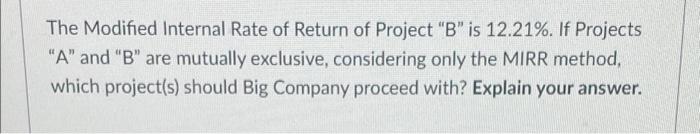

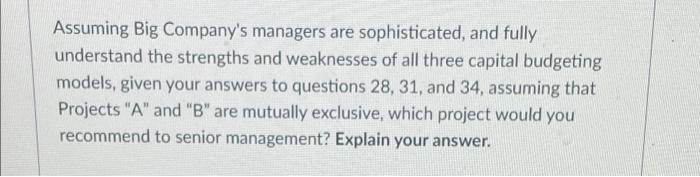

Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The expected Free Cash Flows of the projects are as follows: Period Annual Cash Flows Project "A" Annual Cash Flows Project "B" 0 1 ($30,000) 6,500 9,000 12,000 15,000 ($30,000) 16,500 10,500 2. 3 4 9,000 3,000 Compute the Modified Internal Rate of Return (MIRR) for A Show your inputs/work for partial credit. The Modified Internal Rate of Return of Project "B" is 12.21%. If Projects "A" and "B" are independent, considering only the MIRR method, which project(s) should Big Company proceed with? Explain your answer. The Modified Internal Rate of Return of Project "B" is 12.21%. If Projects "A" and "B" are mutually exclusive, considering only the MIRR method, which project(s) should Big Company proceed with? Explain your answer. Assuming Big Company's managers are sophisticated, and fully understand the strengths and weaknesses of all three capital budgeting models, given your answers to questions 28, 31, and 34, assuming that Projects "A" and "B" are mutually exclusive, which project would you recommend to senior management? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts