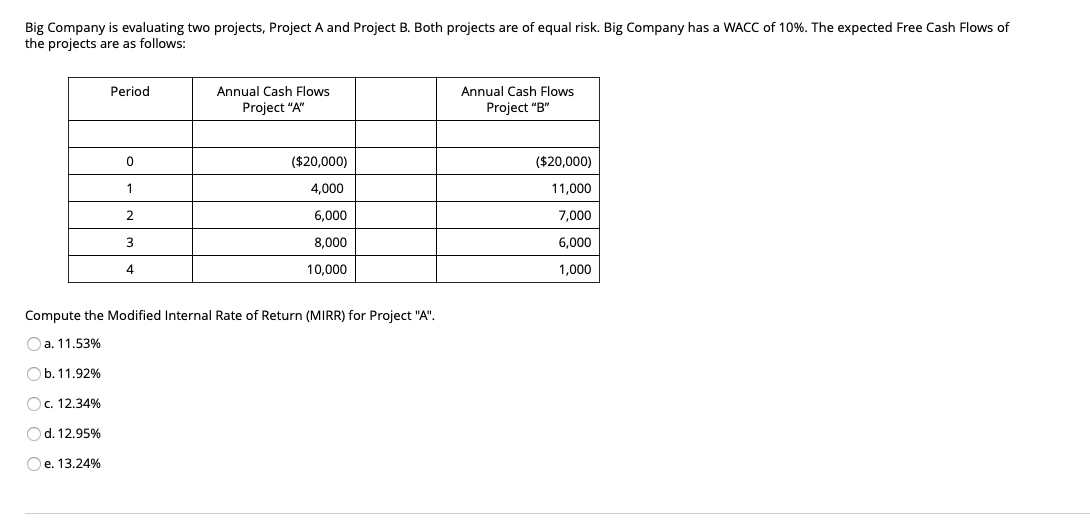

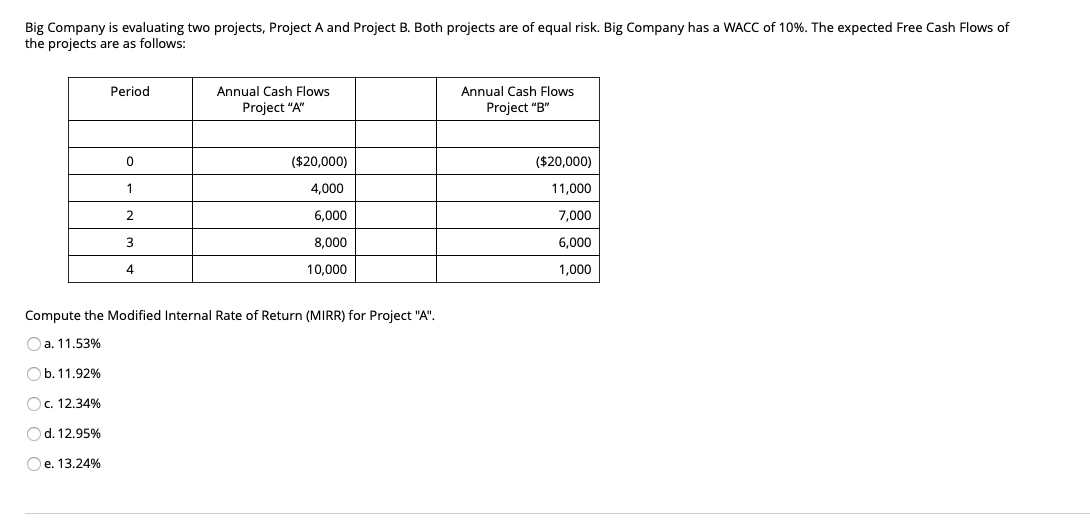

Question: Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The

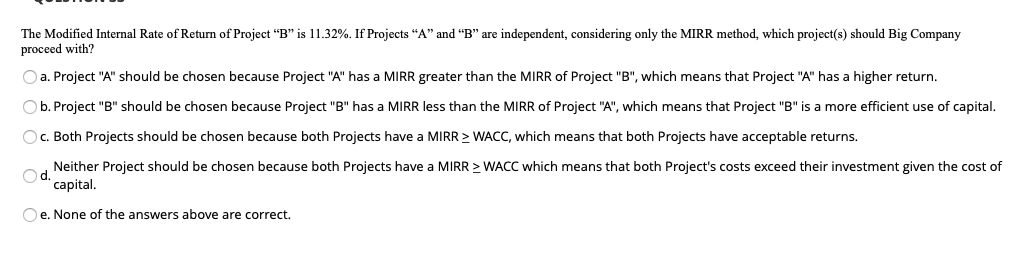

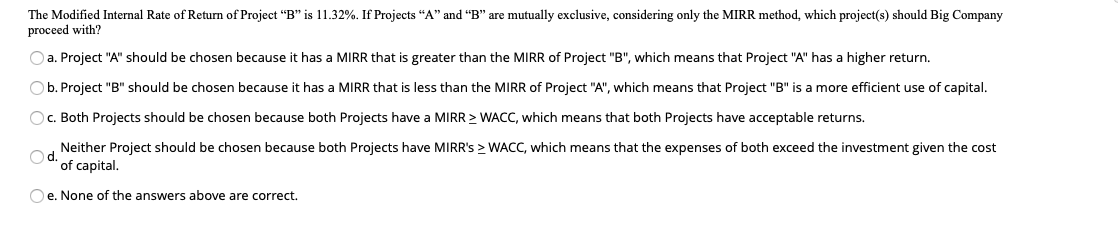

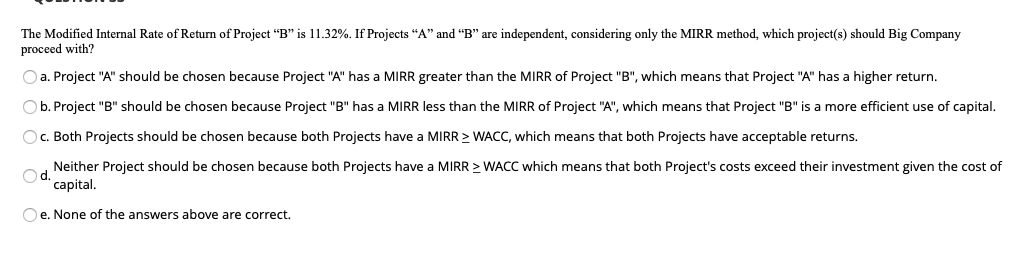

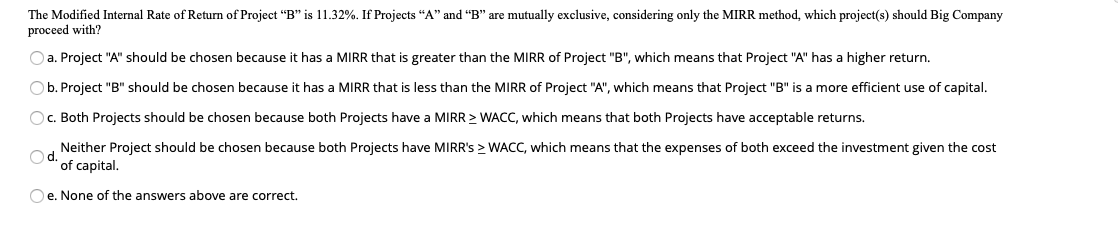

Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The expected Free Cash Flows of the projects are as follows: Period Annual Cash Flows Project "A" Annual Cash Flows Project "B" ($20,000) 4,000 6,000 ($20,000) 11,000 7,000 6,000 1,000 8,000 10,000 Compute the Modified Internal Rate of Return (MIRR) for Project "A". O a. 11.53% Ob. 11.92% O c. 12.34% d. 12.95% Oe. 13.24% The Modified Internal Rate of Return of Project "B" is 11.32%. If Projects "A" and "B" are independent, considering only the MIRR method, which project(s) should Big Company proceed with? a. Project "A" should be chosen because Project "A" has a MIRR greater than the MIRR of Project "B", which means that Project "A" has a higher return. Ob. Project "B" should be chosen because Project "B" has a MIRR less than the MIRR of Project "A", which means that Project "B" is a more efficient use of capital. c. Both Projects should be chosen because both Projects have a MIRR > WACC, which means that both Projects have acceptable returns. Neither Project should be chosen because both Projects have a MIRR > WACC which means that both Project's costs exceed their investment given the cost of capital. Oe. None of the answers above are correct. The Modified Internal Rate of Return of Project "B" is 11.32%. If Projects "A" and "B" are mutually exclusive, considering only the MIRR method, which project(s) should Big Company proceed with? a. Project "A" should be chosen because it has a MIRR that is greater than the MIRR of Project "B", which means that Project "A" has a higher return. b. Project "B" should be chosen because it has a MIRR that is less than the MIRR of Project "A", which means that Project "B" is a more efficient use of capital. c. Both Projects should be chosen because both Projects have a MIRR > WACC, which means that both Projects have acceptable returns. Neither Project should be chosen because both Projects have MIRR's > WACC, which means that the expenses of both exceed the investment given the cost of capital. Oe. None of the answers above are correct. Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The expected Free Cash Flows of the projects are as follows: Period Annual Cash Flows Project "A" Annual Cash Flows Project "B" ($20,000) 4,000 6,000 ($20,000) 11,000 7,000 6,000 1,000 8,000 10,000 Compute the Modified Internal Rate of Return (MIRR) for Project "A". O a. 11.53% Ob. 11.92% O c. 12.34% d. 12.95% Oe. 13.24% The Modified Internal Rate of Return of Project "B" is 11.32%. If Projects "A" and "B" are independent, considering only the MIRR method, which project(s) should Big Company proceed with? a. Project "A" should be chosen because Project "A" has a MIRR greater than the MIRR of Project "B", which means that Project "A" has a higher return. Ob. Project "B" should be chosen because Project "B" has a MIRR less than the MIRR of Project "A", which means that Project "B" is a more efficient use of capital. c. Both Projects should be chosen because both Projects have a MIRR > WACC, which means that both Projects have acceptable returns. Neither Project should be chosen because both Projects have a MIRR > WACC which means that both Project's costs exceed their investment given the cost of capital. Oe. None of the answers above are correct. The Modified Internal Rate of Return of Project "B" is 11.32%. If Projects "A" and "B" are mutually exclusive, considering only the MIRR method, which project(s) should Big Company proceed with? a. Project "A" should be chosen because it has a MIRR that is greater than the MIRR of Project "B", which means that Project "A" has a higher return. b. Project "B" should be chosen because it has a MIRR that is less than the MIRR of Project "A", which means that Project "B" is a more efficient use of capital. c. Both Projects should be chosen because both Projects have a MIRR > WACC, which means that both Projects have acceptable returns. Neither Project should be chosen because both Projects have MIRR's > WACC, which means that the expenses of both exceed the investment given the cost of capital. Oe. None of the answers above are correct