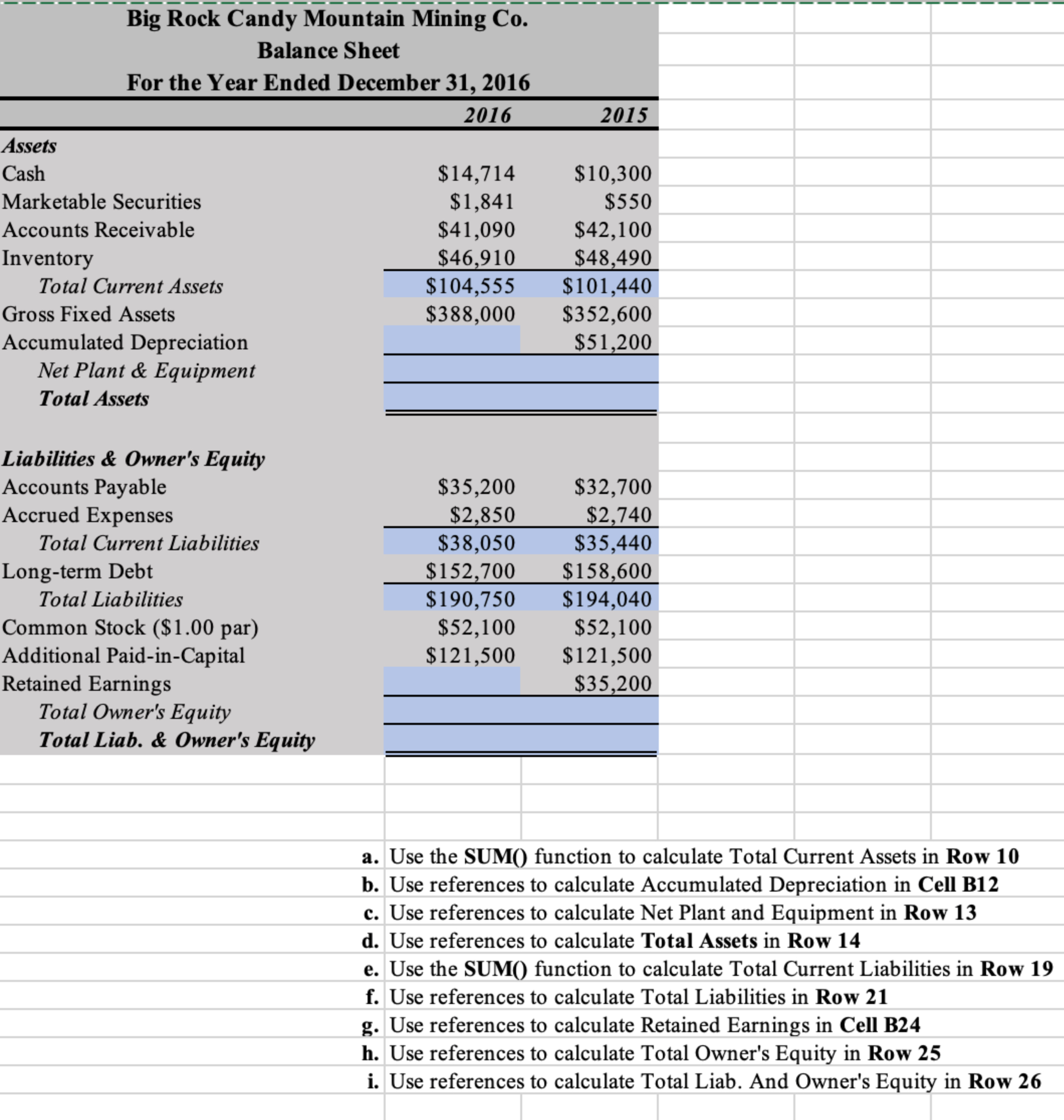

Question: Big Rock Candy Mountain Mining Co . Balance Sheet For the Year Ended December 3 1 , 2 0 1 6 2 0 1 6

Big Rock Candy Mountain Mining Co

Balance Sheet

For the Year Ended December

Assets

Cash $ $

Marketable Securities $ $

Accounts Receivable $ $

Inventory $ $

Total Current Assets $ $

Gross Fixed Assets $ $

Accumulated Depreciation $

Net Plant & Equipment

Total Assets

Liabilities & Owner's Equity

Accounts Payable $ $

Accrued Expenses $ $

Total Current Liabilities $ $

Longterm Debt $ $

Total Liabilities $ $

Common Stock $ par $ $

Additional PaidinCapital $ $

Retained Earnings $

Total Owner's Equity

Total Liab. & Owner's Equity

a Use the SUM function to calculate Total Current Assets in Row a Use the SUM function to calculate Total Current Assets in Row

b Use references to calculate Accumulated Depreciation in Cell B

c Use references to calculate Net Plant and Equipment in Row

d Use references to calculate Total Assets in Row

e Use the SUM function to calculate Total Current Liabilities in Row

f Use references to calculate Total Liabilities in Row

g Use references to calculate Retained Earnings in Cell B

h Use references to calculate Total Owner's Equity in Row

i Use references to calculate Total Liab. And Owner's Equity in Row

b Use references to calculate Accumulated Depreciation in Cell B

c Use references to calculate Net Plant and Equipment in Row

d Use references to calculate Total Assets in Row

e Use the SUM function to calculate Total Current Liabilities in Row

f Use references to calculate Total Liabilities in Row

g Use references to calculate Retained Earnings in Cell B

h Use references to calculate Total Liab. And Owner's Equity in Row

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock