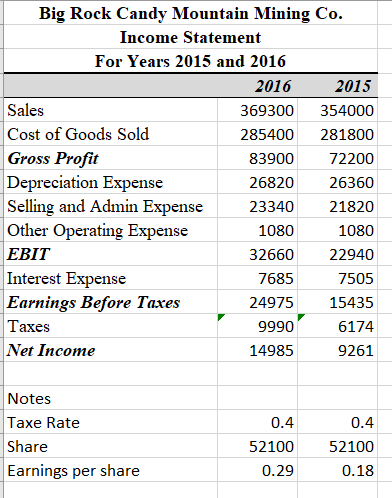

Question: Big Rock Candy Mountain Mining Co. Income Statement For Years 2015 and 2016 2016 2015 Sales 369300 354000 Cost of Goods Sold 285400 281800 Gross

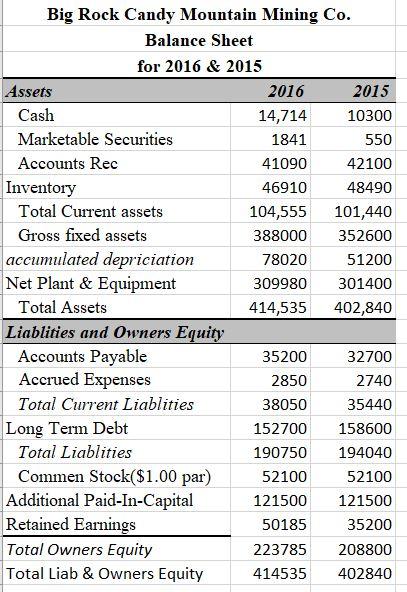

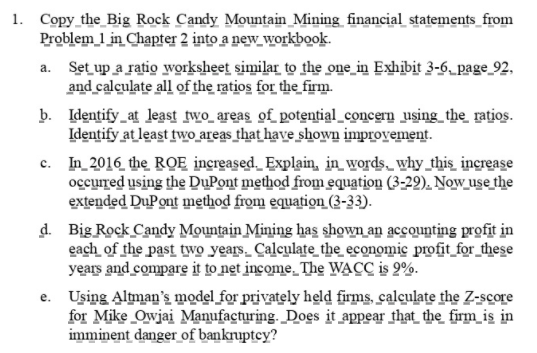

Big Rock Candy Mountain Mining Co. Income Statement For Years 2015 and 2016 2016 2015 Sales 369300 354000 Cost of Goods Sold 285400 281800 Gross Profit 83900 72200 Depreciation Expense 26820 26360 Selling and Admin Expense 23340 21820 Other Operating Expense 1080 1080 EBIT 32660 22940 Interest Expense 7685 7505 Earnings Before Taxes 24975 15435 Taxes 9990 6174 Net Income 14985 9261 Notes Taxe Rate Share Earnings per share 0.4 52100 0.29 0.4 52100 0.18 Big Rock Candy Mountain Mining Co. Balance Sheet for 2016 & 2015 Assets 2016 2015 Cash 14,714 10300 Marketable Securities 1841 550 Accounts Rec 41090 42100 Inventory 46910 48490 Total Current assets 104,555 101,440 Gross fixed assets 388000 352600 accumulated depriciation 78020 51200 Net Plant & Equipment 309980 301400 Total Assets 414,535 402,840 Liablities and Owners Equity Accounts Payable 35200 32700 Accrued Expenses 2850 2740 Total Current Liablities 38050 35440 Long Term Debt 152700 158600 Total Liablities 190750 194040 Commen Stock($1.00 par) 52100 52100 Additional Paid-In-Capital 121500 121500 Retained Earnings 50185 35200 Total Owners Equity 223785 208800 Total Liab & Owners Equity 414535 402840 1. Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a new_workbook. a. Set up a ratio worksheet similar to the one_in Exhibit 3-6, page 92, and calculate all of the ratios for the firm. b. Identify at least two areas of potential_concern using the ratios. Identify at least two areas that have shown improvement. c. In 2016 the ROE increased. Explain, in words, why this increase occurred using the DuPont method from equation (3-29). Now_use the extended DuPont method from equation (3-33). d. Big Rock Candy Mountain Mining has shown an accounting profit in each of the past two years. Calculate the economic profit_for_these years and compare it to net income. The WACC is 9%. e. Using Altman's model for privately held firms, calculate the Z-score for Mike Owjai Manufacturing. Does it appear that the firm is in imminent danger of bankruptcy? Big Rock Candy Mountain Mining Co. Income Statement For Years 2015 and 2016 2016 2015 Sales 369300 354000 Cost of Goods Sold 285400 281800 Gross Profit 83900 72200 Depreciation Expense 26820 26360 Selling and Admin Expense 23340 21820 Other Operating Expense 1080 1080 EBIT 32660 22940 Interest Expense 7685 7505 Earnings Before Taxes 24975 15435 Taxes 9990 6174 Net Income 14985 9261 Notes Taxe Rate Share Earnings per share 0.4 52100 0.29 0.4 52100 0.18 Big Rock Candy Mountain Mining Co. Balance Sheet for 2016 & 2015 Assets 2016 2015 Cash 14,714 10300 Marketable Securities 1841 550 Accounts Rec 41090 42100 Inventory 46910 48490 Total Current assets 104,555 101,440 Gross fixed assets 388000 352600 accumulated depriciation 78020 51200 Net Plant & Equipment 309980 301400 Total Assets 414,535 402,840 Liablities and Owners Equity Accounts Payable 35200 32700 Accrued Expenses 2850 2740 Total Current Liablities 38050 35440 Long Term Debt 152700 158600 Total Liablities 190750 194040 Commen Stock($1.00 par) 52100 52100 Additional Paid-In-Capital 121500 121500 Retained Earnings 50185 35200 Total Owners Equity 223785 208800 Total Liab & Owners Equity 414535 402840 1. Copy the Big Rock Candy Mountain Mining financial statements from Problem 1 in Chapter 2 into a new_workbook. a. Set up a ratio worksheet similar to the one_in Exhibit 3-6, page 92, and calculate all of the ratios for the firm. b. Identify at least two areas of potential_concern using the ratios. Identify at least two areas that have shown improvement. c. In 2016 the ROE increased. Explain, in words, why this increase occurred using the DuPont method from equation (3-29). Now_use the extended DuPont method from equation (3-33). d. Big Rock Candy Mountain Mining has shown an accounting profit in each of the past two years. Calculate the economic profit_for_these years and compare it to net income. The WACC is 9%. e. Using Altman's model for privately held firms, calculate the Z-score for Mike Owjai Manufacturing. Does it appear that the firm is in imminent danger of bankruptcy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts