Question: Big Rock candy Mountain mining co. income statement for the years 2019 and 2020. Big Rock Candy Mountain Mining Co. Statement of Cash Flows For

Big Rock candy Mountain mining co. income statement for the years 2019 and 2020. Big Rock Candy Mountain Mining Co. Statement of Cash Flows For the Year Ended December 31, 2020 Cash Flows from Operations Net Income Depreciation Expense Change in Marketable Securities Change in Accounts Receivable Change in Inventory Change in Accounts Payable Change in Accrued Expenses Total Cash Flows from Operations Cash Flows from Investing Change in Gross Fixed Assets Total Cash Flows from Investing Cash Flows from Financing Change in Long-term Debt Change in Common Stock ($2 par) Change in Additional Paid-in-Capital Total Cash Flows from Financing Net Change in Cash Balance.

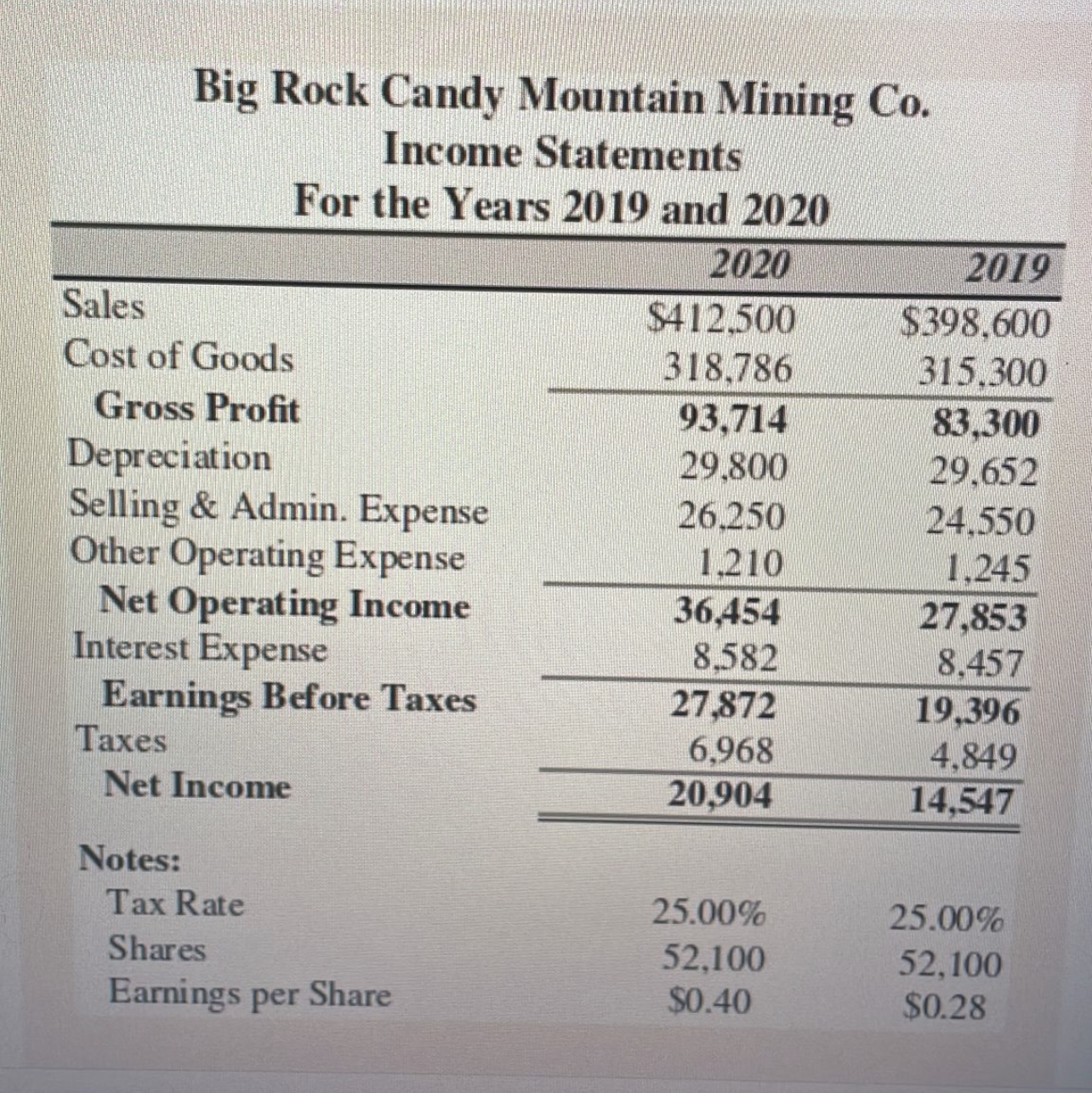

Big Rock Candy Mountain Mining Co. Income Statements For the Years 2019 and 2020 \begin{tabular}{lrr} \hline & 2020 & 2019 \\ \hline Sales & $412,500 & $398,600 \\ Cost of Goods & 318,786 & 315,300 \\ \cline { 2 - 3 } Gross Profit & 93,714 & 83,300 \\ Depreciation & 29,800 & 29,652 \\ Selling \& Admin. Expense & 26,250 & 24,550 \\ Other Operating Expense & 1,210 & 1,245 \\ \cline { 2 - 3 } Net Operating Income & 36,454 & 27,853 \\ Interest Expense & 8,582 & 8,457 \\ \cline { 2 - 3 } Earnings Before Taxes & 27,872 & 19,396 \\ Taxes & 6,968 & 4,849 \\ \cline { 2 - 3 } Net Income & 20,904 & 14,547 \\ Notes: & & \\ Tax Rate & 25,00% & 25.00% \\ Shares & 52,100 & 52,100 \\ Earnings per Share & $0.40 & $0.28 \\ & & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts