Question: Bilingham Packaging is considering expanding its production capacty by purchasing a now mochine, the XC-750. The cost of the XC-780 is 32.71 million. Unfortunathy, installing

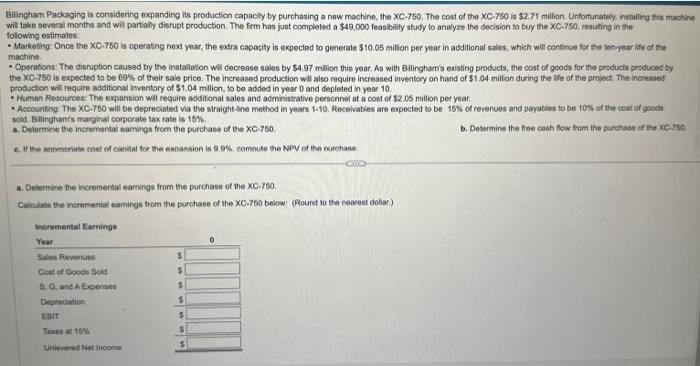

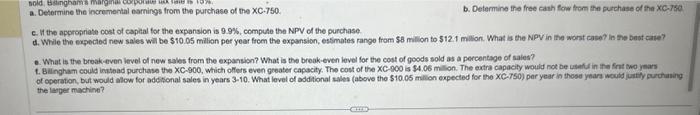

Bilingham Packaging is considering expanding its production capacty by purchasing a now mochine, the XC-750. The cost of the XC-780 is 32.71 million. Unfortunathy, installing thy machine wit take several months and wil partioly disnupt production. The firm has just completed a $49,000 feasiblity study to analyze the decision to buy the xC - 750 , resuting in the following estimalosit - Markoting. Once the XC-750 is cperating next year, the extra capecity is expected to generate $10.05 million per year in additional sales, which will conthue for the tenyear ifte of the machine, - Operations: The disruption causad by the instalision will decrease salas by $4.97 milion this year. As with Bllinghamis eciting producta, the cost of goods for the producti produced by the XC750 is expected to be 69% of their sae price. The increased production will also require increased invertory on hand of $1.04 milfon during the ife of the project The incrassed production will require additional inventory of $1.04 millicn, to be added in year 0 and depleted in year 10. - Human Retoures. The expansion will require additional sales and acministrative perscnnel at a cost of 52.05 million por year. - Accounting: The XC.750 will be depreciated via the straight-ine method in years 1 -10. Receivabies are expected to be 15W of revenues and payables to be tos of the coit of gooth sold. Bllinghamis marginal comporate tax tate is 15%. a. Determine the incrimental earmings from the purchase of the C750. b. Desermine the free cash flow frem the purchase of the Xe-rse. c. If the monotrime cost of canital for the exoansion is 9.9%. comoute the NPV of the cumbhase. a. Desermine the incremental eamings from the purchase of the xC760. Calculate the incrementai earmings from the purchase of the XC-750 belew: (Round to the reavest dollar) a. Determine the incremental earnings from the purchase of the XC.750. b. Determine the free cath fow from the purchase of the XC-7ted c. It the approbriate cost of capilal for the expansion is 9.9%, compute the NPV of the purchase. d. While the expectod new sales will be $10.05 milion per year frem the expansion, estimates range from 58 millon to 512.1 milion. What is the NpV in the worst case? In the bast care? 2. What is the breaketven level of new sales from the expagsion? What is the break-even level for the cost of goods sold as a percentsge of saies? t. Blingham could inatead purchase the XC. 900 , which oflers even gseater capacily, The cost of the XC-900 is $4.06 millon. The extra capacily would not be usafur in ite frnt two yeas the laper machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts