Question: Binomial Interest Rate Tree - 30 points Use the following interest rate tree to answer the questions. You have estimated the risk neutral model for

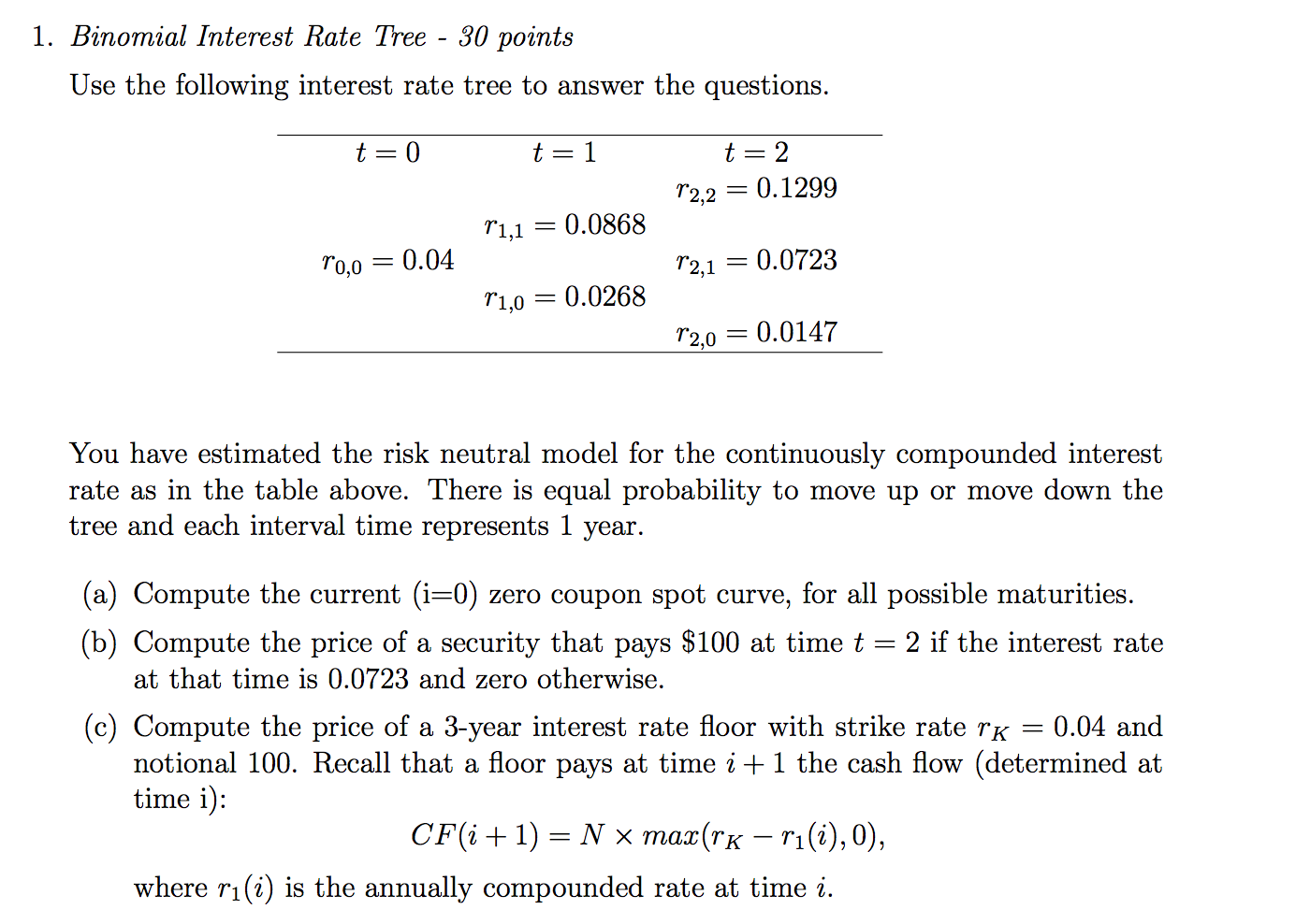

Binomial Interest Rate Tree - 30 points Use the following interest rate tree to answer the questions. You have estimated the risk neutral model for the continuously compounded interest rate as in the table above. There is equal probability to move up or move down the tree and each interval time represents 1 year. Compute the current (i=0) zero coupon spot curve, for all possible maturities. Compute the price of a security that pays $100 at time t = 2 if the interest rate at that time is 0.0723 and zero otherwise. Compute the price of a 3-year interest rate floor with strike rate r_K = 0.04 and notional 100. Recall that a floor pays at time i + 1 the cash flow (determined at time i): CF(i + 1) = N times max(r_K - r_1 (i), 0), where r_1(i) is the annually compounded rate at time i. Binomial Interest Rate Tree - 30 points Use the following interest rate tree to answer the questions. You have estimated the risk neutral model for the continuously compounded interest rate as in the table above. There is equal probability to move up or move down the tree and each interval time represents 1 year. Compute the current (i=0) zero coupon spot curve, for all possible maturities. Compute the price of a security that pays $100 at time t = 2 if the interest rate at that time is 0.0723 and zero otherwise. Compute the price of a 3-year interest rate floor with strike rate r_K = 0.04 and notional 100. Recall that a floor pays at time i + 1 the cash flow (determined at time i): CF(i + 1) = N times max(r_K - r_1 (i), 0), where r_1(i) is the annually compounded rate at time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts