Question: Binomial Tree Period: One-Period In a one-period binomial tree model, the current price of an underlying stock is S- $100, the stock pays dividend continuously

Binomial Tree Period: One-Period

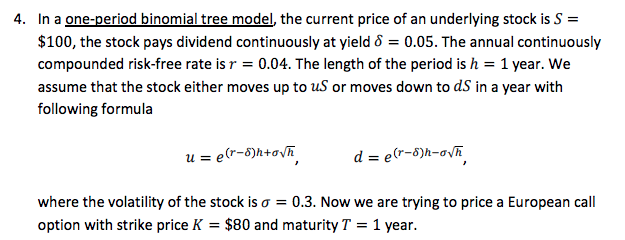

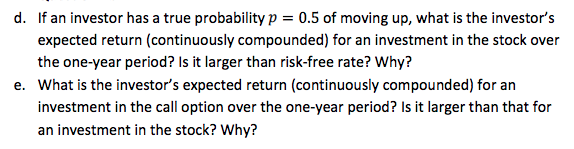

In a one-period binomial tree model, the current price of an underlying stock is S- $100, the stock pays dividend continuously at yield 60.05. The annual continuously compounded risk-free rate isr 0.04. The length of the period is h-1 year. We assume that the stock either moves up to uS or moves down to dS in a year with following formula 4. where the volatility of the stock is 0.3. Now we are trying to price a European call option with strike price K $80 and maturity T1 year. In a one-period binomial tree model, the current price of an underlying stock is S- $100, the stock pays dividend continuously at yield 60.05. The annual continuously compounded risk-free rate isr 0.04. The length of the period is h-1 year. We assume that the stock either moves up to uS or moves down to dS in a year with following formula 4. where the volatility of the stock is 0.3. Now we are trying to price a European call option with strike price K $80 and maturity T1 year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts