Question: Financial Math Problem: Binomial Tree Pricing Model Bonus Problem 1 (Optional, 25 marks) The current price of an asset is $100 and the asset pays

Financial Math Problem: Binomial Tree Pricing Model

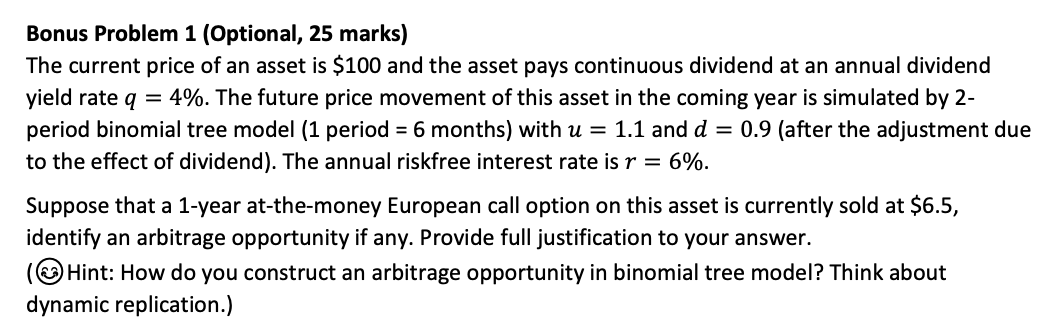

Bonus Problem 1 (Optional, 25 marks) The current price of an asset is $100 and the asset pays continuous dividend at an annual dividend yield rate q = 4%. The future price movement of this asset in the coming year is simulated by 2- period binomial tree model (1 period = 6 months) with u = 1.1 and d = 0.9 (after the adjustment due to the effect of dividend). The annual riskfree interest rate is r = 6%. Suppose that a 1-year at-the-money European call option on this asset is currently sold at $6.5, identify an arbitrage opportunity if any. Provide full justification to your answer. (Hint: How do you construct an arbitrage opportunity in binomial tree model? Think about dynamic replication.) Bonus Problem 1 (Optional, 25 marks) The current price of an asset is $100 and the asset pays continuous dividend at an annual dividend yield rate q = 4%. The future price movement of this asset in the coming year is simulated by 2- period binomial tree model (1 period = 6 months) with u = 1.1 and d = 0.9 (after the adjustment due to the effect of dividend). The annual riskfree interest rate is r = 6%. Suppose that a 1-year at-the-money European call option on this asset is currently sold at $6.5, identify an arbitrage opportunity if any. Provide full justification to your answer. (Hint: How do you construct an arbitrage opportunity in binomial tree model? Think about dynamic replication.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts