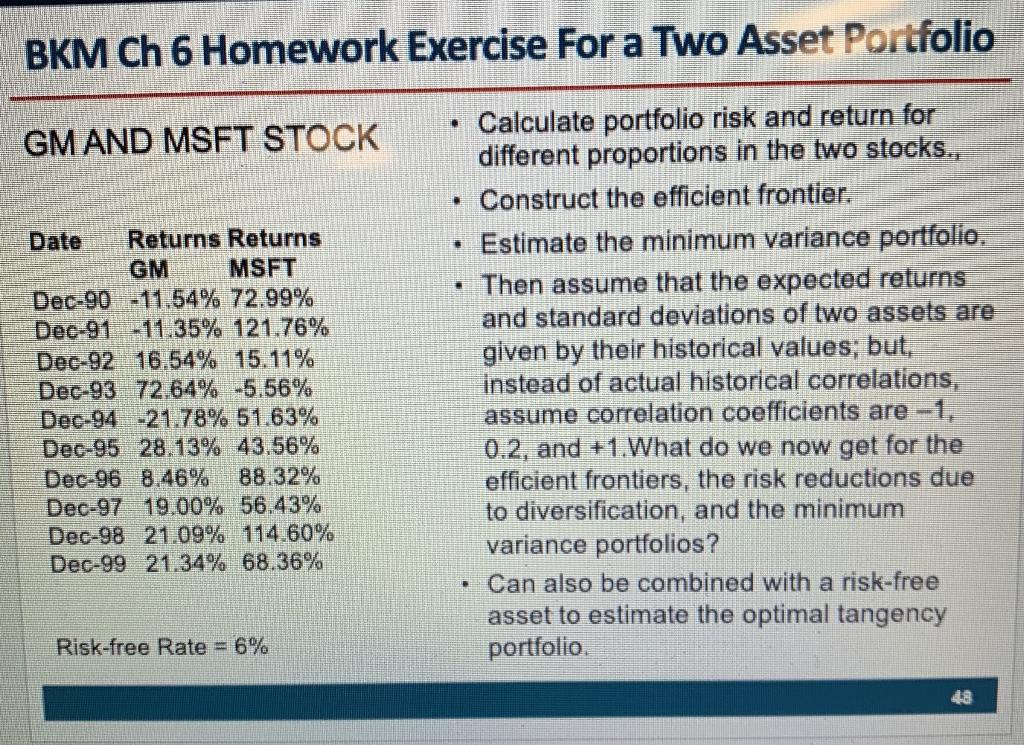

Question: BKM Ch 6 Homework Exercise For a Two Asset Portfolio GM AND MSFT STOCK Date Returns Returns GM MSFT Dec-90 -11.54% 72.99% Dec-91 -11.35% 121.76%

BKM Ch 6 Homework Exercise For a Two Asset Portfolio GM AND MSFT STOCK Date Returns Returns GM MSFT Dec-90 -11.54% 72.99% Dec-91 -11.35% 121.76% Dec-92 16.54% 15.11% Dec-93 72.64% -5.56% Dec-94-21.78% 51.63% Dec-95 28.13% 43.56% Dec-96 8.46% 88.32% Dec-97 19.00% 56.43% Dec-98 21.09% 114.60% Dec-99 21.34% 68.36% Calculate portfolio risk and return for different proportions in the two stocks., Construct the efficient frontier. Estimate the minimum variance portfolio. Then assume that the expected returns and standard deviations of two assets are given by their historical values; but, instead of actual historical correlations, assume correlation coefficients are -1, 0.2, and +1.What do we now get for the efficient frontiers, the risk reductions due to diversification, and the minimum variance portfolios? Can also be combined with a risk-free asset to estimate the optimal tangency portfolio Risk-free Rate = 6% 48 BKM Ch 6 Homework Exercise For a Two Asset Portfolio GM AND MSFT STOCK Date Returns Returns GM MSFT Dec-90 -11.54% 72.99% Dec-91 -11.35% 121.76% Dec-92 16.54% 15.11% Dec-93 72.64% -5.56% Dec-94-21.78% 51.63% Dec-95 28.13% 43.56% Dec-96 8.46% 88.32% Dec-97 19.00% 56.43% Dec-98 21.09% 114.60% Dec-99 21.34% 68.36% Calculate portfolio risk and return for different proportions in the two stocks., Construct the efficient frontier. Estimate the minimum variance portfolio. Then assume that the expected returns and standard deviations of two assets are given by their historical values; but, instead of actual historical correlations, assume correlation coefficients are -1, 0.2, and +1.What do we now get for the efficient frontiers, the risk reductions due to diversification, and the minimum variance portfolios? Can also be combined with a risk-free asset to estimate the optimal tangency portfolio Risk-free Rate = 6% 48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts