Question: Could I please get some help with what formuals/solutions to use in this problem? Thanks. Calculate the average returns and portfolios composed of 30% GM

Could I please get some help with what formuals/solutions to use in this problem? Thanks.

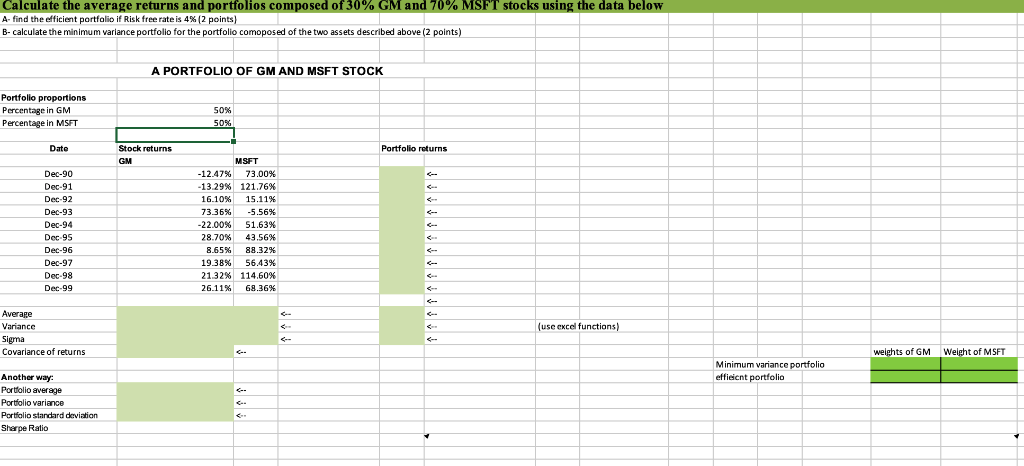

Calculate the average returns and portfolios composed of 30% GM and 70% MSFT stocks using the data below A-find the efficient portfolio if Risk free rate is 4% (2 points) B-calculate the minimum variance portfolio for the portfolio comoposed of the two assets described above (2 points) A PORTFOLIO OF GM AND MSFT STOCK Portfolio proportions Percentage in GM Percentage in MSFT 50% Date Stock returns GM Portfolio returns MSFT Dec-90 Dec-91 Dec-92 Dec-93 Dec-94 Dec 95 Det-96 Dec-97 Dec-98 Dec-99 12.47% 13.29% 16.10% 73.36% -22.00% 28.70% 8.65% 19.38% 21.32% 26.11% 73.00% 121.76% 15.11% -5.56% 51.63% 43.56% 88.32% 56.43% 114.60% 68.36% Average Variance Signa Covariance of returns use excel functions weights of GM Weight of MSFT Minimum variance portfolio effieicnt portfolio Another way: Portolio average Portiolio variance Portiolio standard deviatian Sharpe Ratio Calculate the average returns and portfolios composed of 30% GM and 70% MSFT stocks using the data below A-find the efficient portfolio if Risk free rate is 4% (2 points) B-calculate the minimum variance portfolio for the portfolio comoposed of the two assets described above (2 points) A PORTFOLIO OF GM AND MSFT STOCK Portfolio proportions Percentage in GM Percentage in MSFT 50% Date Stock returns GM Portfolio returns MSFT Dec-90 Dec-91 Dec-92 Dec-93 Dec-94 Dec 95 Det-96 Dec-97 Dec-98 Dec-99 12.47% 13.29% 16.10% 73.36% -22.00% 28.70% 8.65% 19.38% 21.32% 26.11% 73.00% 121.76% 15.11% -5.56% 51.63% 43.56% 88.32% 56.43% 114.60% 68.36% Average Variance Signa Covariance of returns use excel functions weights of GM Weight of MSFT Minimum variance portfolio effieicnt portfolio Another way: Portolio average Portiolio variance Portiolio standard deviatian Sharpe Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts