Question: Bla. Illustration case: On Janary 2 , Year 7 , Bob the Builder purchases 1 0 call eption contracts from Scoop by paying $ 4

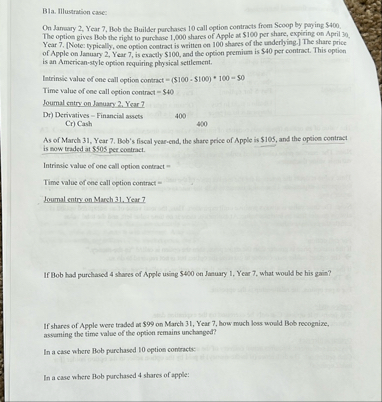

Bla. Illustration case:

On Janary Year Bob the Builder purchases call eption contracts from Scoop by paying $ The option gives Bob the right to purchase shares of Apple at $ per share, expiring on April Year Note: typically, one opeion contrast is written on shares of the underlying. The share price of Apple on January Year is exactly $ and the option premium is $ per contract. This option is an Americanstyle option requiring physical settlement.

Intrinsic value of one call option contract $$

Time value of one call eption contract $

Joumal entry on January Year

Derivatives Financial assets

Cr Cash

As of March Year Bob's fiscal ycarend, the share price of Apple is $ and the opeion contract is now traded at $ per coetract.

Intrinsic value of one call eption contract

Time value of ene call eption contract

Joural entry on March Year

If Bob had purchased shares of Apple using $ on January Year what would be his gain?

If shares of Apple were traded at on March Year how much loss would Bob recognize, assaming the time value of the option remains unchanged?

In a case where Bob purchased option contracts:

In a case where Bob purchased shares of apple:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock