Question: Blank Options: decrease/increases greater/lower less/more increase/reduce 11. The relationship between a firm's capital structure and other company attributes Aa Aa As a firm takes on

Blank Options:

Blank Options:

decrease/increases

greater/lower

less/more

increase/reduce

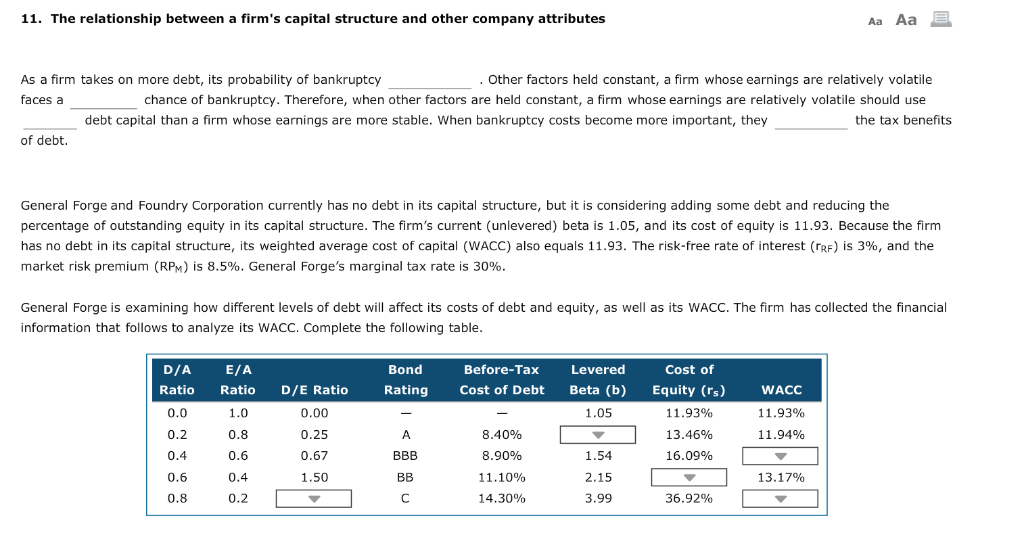

11. The relationship between a firm's capital structure and other company attributes Aa Aa As a firm takes on more debt, its probability of bankruptcy faces a Other factors held constant, a firm whose earnings are relatively volatile chance of bankruptcy. Therefore, when other factors are held constant, a firm whose earnings are relatively volatile should use debt capital than a firm whose earnings are more stable. When bankruptcy costs become more important, they the tax benefits of debt. General Forge and Foundry Corporation currently has no debt in its capital structure, but it is considering adding some debt and reducing the percentage of outstanding equity in its capital structure. The firm's current (unlevered) beta is 1.05, and its cost of equity is 11.93. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 11.93. The risk-free rate of interest (rRF) is 3%, and the market risk premium (RPM) is 8.5%. General Forge's marginal tax rate is 30% General Forge is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its WACC. Complete the following table D/A E/A Ratio Ratio D/E Ratio Bond Before-Tax Levered Beta (b) 1.05 Cost of Equity (rs) 11 .93% 13.46% 16.09% Rating Cost of Debt WACC 11 .93% 11.94% 0.0 0.8 0.6 0.4 0.2 0.00 0.25 0.67 1.50 8.40% 8.90% 11.10% 14.30% 0.2 1.54 2.15 3.99 0.6 13.17% 0.8 36.92%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts