Question: ble Window Help AutoSave 08-0 nsert Draw Design Layout - Documents References Tell me Share Calibrio 11 - ' ' A 8 IV x x

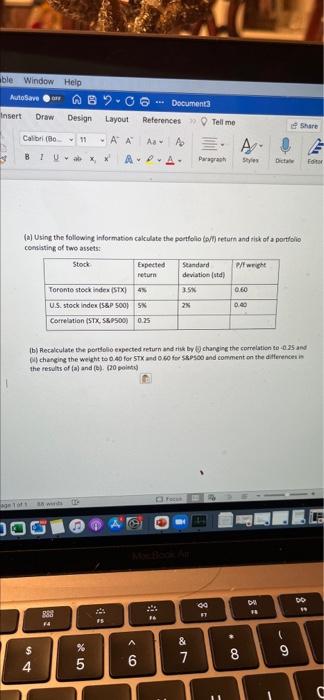

ble Window Help AutoSave 08-0 nsert Draw Design Layout - Documents References Tell me Share Calibrio 11 - ' ' A 8 IV x x APA- A Pwgh Sy Di FOR (a) Using the following Information calculate the portfolio bal} return and risk of a portfolio consisting of two assets Stock Expected Standard 1/f wright return deviation (ud) Toronto stock index (STX) 4% 35 0.60 U.S. stock index (56P 500 SX 2 0.00 Correlation (STX, S&P500) 0.25 b) Recalculate the portfolio expected return and by changing the correlation to 0.5 and changing the weight to 0.40 For STX und 0.60 S&Psco and comment on the differences the results of (a) and (b) (20 pm F DOG DO 00 FT :9 RA F 76 FS A $ 4 % 5 & 7 9 8 6 C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts