Question: Bloomberg Exercise 1 Stock Return and Risk Select a stock of interest and examine its return and risk compared to one of its peer firm

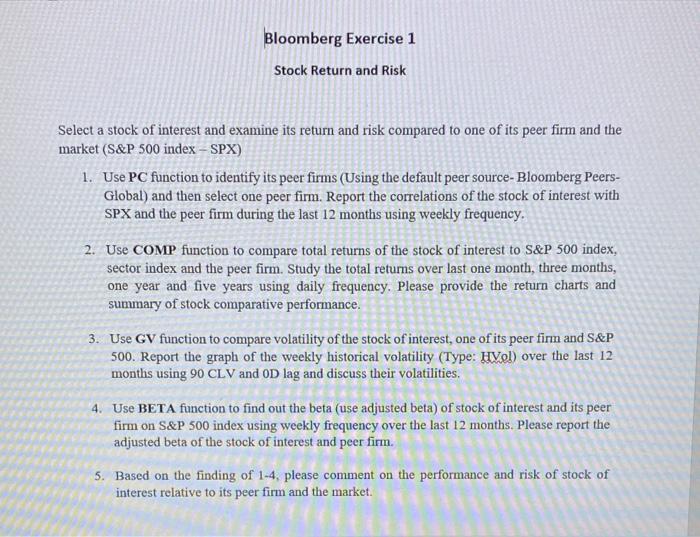

Bloomberg Exercise 1 Stock Return and Risk Select a stock of interest and examine its return and risk compared to one of its peer firm and the market (S&P 500 index - SPX) 1. Use PC function to identify its peer firms (Using the default peer source- Bloomberg Peers- Global) and then select one peer firm. Report the correlations of the stock of interest with SPX and the peer firm during the last 12 months using weekly frequency. 2. Use COMP function to compare total returns of the stock of interest to S&P 500 index, sector index and the peer firm. Study the total returns over last one month, three months, one year and five years using daily frequency. Please provide the return charts and summary of stock comparative performance. 3. Use GV function to compare volatility of the stock of interest, one of its peer firm and S&P 500. Report the graph of the weekly historical volatility (Type: HVol) over the last 12 months using 90 CLV and OD lag and discuss their volatilities, 4. Use BETA function to find out the beta (use adjusted beta) of stock of interest and its peer firm on S&P 500 index using weekly frequency over the last 12 months. Please report the adjusted beta of the stock of interest and peer firm. 5. Based on the finding of 1-4, please comment on the performance and risk of stock of interest relative to its peer firm and the market. Bloomberg Exercise 1 Stock Return and Risk Select a stock of interest and examine its return and risk compared to one of its peer firm and the market (S&P 500 index - SPX) 1. Use PC function to identify its peer firms (Using the default peer source- Bloomberg Peers- Global) and then select one peer firm. Report the correlations of the stock of interest with SPX and the peer firm during the last 12 months using weekly frequency. 2. Use COMP function to compare total returns of the stock of interest to S&P 500 index, sector index and the peer firm. Study the total returns over last one month, three months, one year and five years using daily frequency. Please provide the return charts and summary of stock comparative performance. 3. Use GV function to compare volatility of the stock of interest, one of its peer firm and S&P 500. Report the graph of the weekly historical volatility (Type: HVol) over the last 12 months using 90 CLV and OD lag and discuss their volatilities, 4. Use BETA function to find out the beta (use adjusted beta) of stock of interest and its peer firm on S&P 500 index using weekly frequency over the last 12 months. Please report the adjusted beta of the stock of interest and peer firm. 5. Based on the finding of 1-4, please comment on the performance and risk of stock of interest relative to its peer firm and the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts