Question: Blur Corp. recently raised capital through an initial public offering (IPO), Its stock can now be purchased on the NYSE, This company is referred to

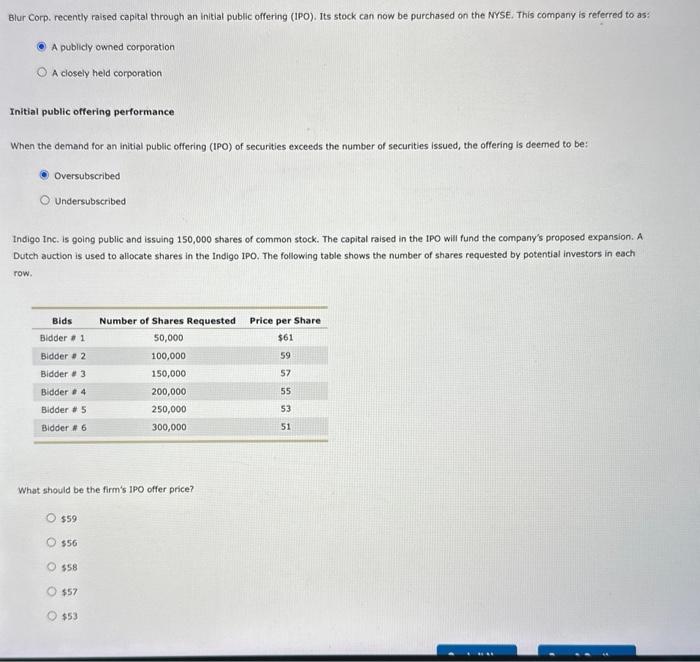

Blur Corp. recently raised capital through an initial public offering (IPO), Its stock can now be purchased on the NYSE, This company is referred to as: A publicly owned corporation A closely held corporation Initial public offering performance When the demand for an initial public offering (IPO) of securities exceeds the number of securities issued, the offering is deemed to be: Oversubscribed Undersubscribed Indigo Inc. is going public and issuing 150,000 shares of common stock. The capital raised in the IPO will fund the company's proposed expansion. A Dutch auction is used to allocate shares in the Indigo IPO. The following table shows the number of shares requested by potential investors in each row. What should be the firm's IPO offer price? 559 $56 558 $57 $53

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts