Question: BMP Products Itd BMP ) has been in operation for more than 20 years . Ten years ago planning for future growth of it's manufacturing

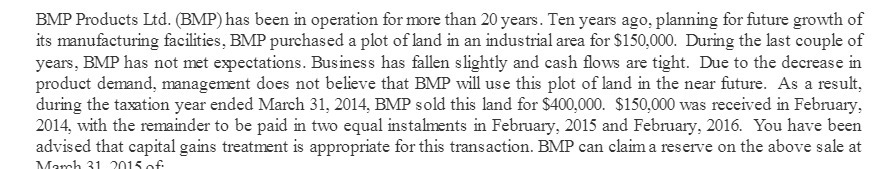

BMP Products Itd BMP ) has been in operation for more than 20 years . Ten years ago planning for future growth of it's manufacturing facilities , BMP purchased a plot of land in an industrial area for $150 000 . During the last couple of years , BMP has not met expectations . Business has fallen's lightly and cash flows are tight . Due to the decrease in to the creas product demand management does not believe that BMP will use this plot of land in the near future . As a result , during the taxation year ended March 31 . 2014 BMP sold this land for $400.000 . $150.100 was received in February 2014 . with the remainder to be paid in two equal instalments in February 2015 and February 2016 . You have been advised that capital gains treatment is appropriate for this transaction . BMP can claim a reserve on the above sale a To 21 oneof

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts