Question: bob tricker and the case study information below. Case Study: Board architecture at Arcelor Mittal The merger of steel makers Arcelor and Mittal in 2006

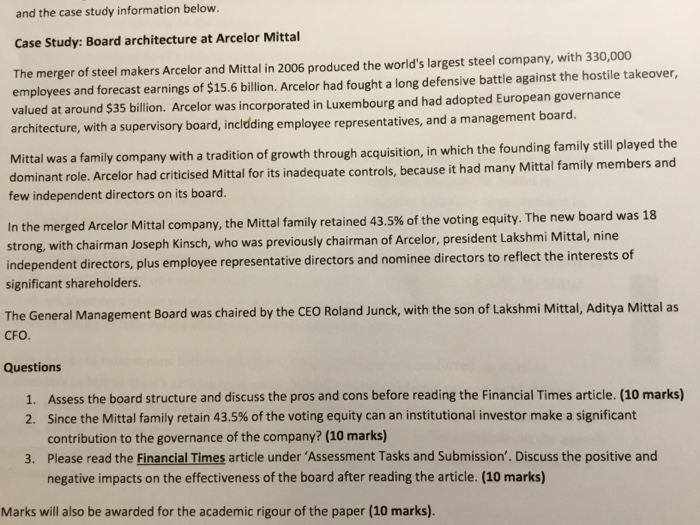

and the case study information below. Case Study: Board architecture at Arcelor Mittal The merger of steel makers Arcelor and Mittal in 2006 produced the world's largest steel company, with 330,000 employees and for valued at around $35 billion. Arc architecture, with a supervisory board, incldding employe recast earnings of $15.6 billion. Arcelor had fought a long defensive battle against the hostile takeover, elor was incorporated in Luxembourg and had adopted European governance e representatives, and a management board. Mittal was dominant role. Arcel few independent directors on its board. a family company with a tradition of growth through acquisition, in which the founding family still played the lor had criticised Mittal for its inadequate controls, because it had many Mittal family members and In the merged Arcelor Mittal company, the Mittal family retained 43.5% of the voting equity. The new board was 18 ith chairman Joseph Kinsch, who was previously chairman of Arcelor, president Lakshmi Mittal, nine independent directors, plus employee representative directors and nominee directors to reflect the interests of significant shareholders. The General Management Board was chaired by the CEO Roland Junck, with the son of Lakshmi Mittal, Aditya Mittal as CFO Questions 1. 2. Assess the board structure and discuss the pros and cons before reading the Financial Times article. (10 marks) Since the Mittal family retain 43.5% of the voting equity can an institutional investor make a significant contribution to the governance of the company? (10 marks) 3. Please read the Financial Times article under 'Assessment Tasks and Submission'. Discuss the positive and negative impacts on the effectiveness of the board after reading the article. (10 marks) Marks will also be awarded for the academic rigour of the paper (10 marks). and the case study information below. Case Study: Board architecture at Arcelor Mittal The merger of steel makers Arcelor and Mittal in 2006 produced the world's largest steel company, with 330,000 employees and for valued at around $35 billion. Arc architecture, with a supervisory board, incldding employe recast earnings of $15.6 billion. Arcelor had fought a long defensive battle against the hostile takeover, elor was incorporated in Luxembourg and had adopted European governance e representatives, and a management board. Mittal was dominant role. Arcel few independent directors on its board. a family company with a tradition of growth through acquisition, in which the founding family still played the lor had criticised Mittal for its inadequate controls, because it had many Mittal family members and In the merged Arcelor Mittal company, the Mittal family retained 43.5% of the voting equity. The new board was 18 ith chairman Joseph Kinsch, who was previously chairman of Arcelor, president Lakshmi Mittal, nine independent directors, plus employee representative directors and nominee directors to reflect the interests of significant shareholders. The General Management Board was chaired by the CEO Roland Junck, with the son of Lakshmi Mittal, Aditya Mittal as CFO Questions 1. 2. Assess the board structure and discuss the pros and cons before reading the Financial Times article. (10 marks) Since the Mittal family retain 43.5% of the voting equity can an institutional investor make a significant contribution to the governance of the company? (10 marks) 3. Please read the Financial Times article under 'Assessment Tasks and Submission'. Discuss the positive and negative impacts on the effectiveness of the board after reading the article. (10 marks) Marks will also be awarded for the academic rigour of the paper (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts