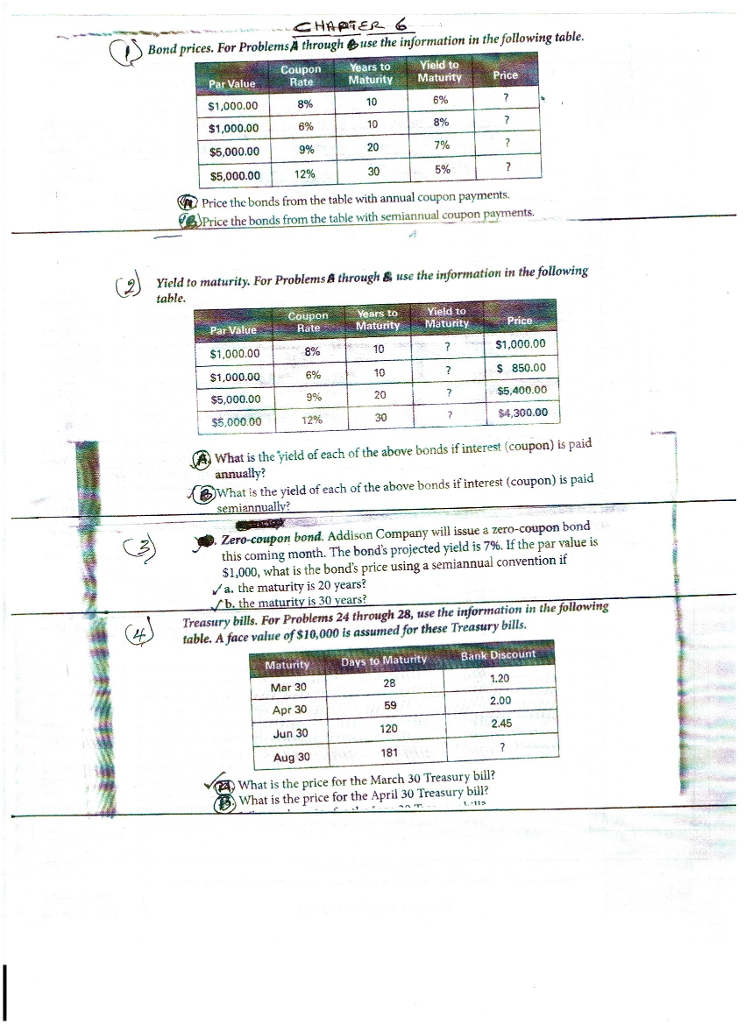

Question: Bond prices. For Problems A through use the information in the following table. Price the bonds from the table with annual coupon payments. Price the

Bond prices. For Problems A through use the information in the following table. Price the bonds from the table with annual coupon payments. Price the bonds from the table with semiannual coupon payments. Yield to maturity. For Problems through use the information in the following table. A. What is the yield of each of the above bonds if interest coupon) is paid annually? B. What is the yield of each of the above bonds if interest (coupon) is paid semiannually? Zero-coupon bond. Addison Company will issue a zero-coupon bond this coming month. The bonds projected yield is 7%. If the par value is $1,000, what is the bond's price using a semiannual convention if a. the maturity is 20 years? b. the maturity is 30 years? Treasury bills. For Problems 24 through 28, use the information in the following table. A face value of $10,000 is assumed for these Treasury bills. What is the price for the March 30 Treasury bill? What is the price for the April 30 Treasury bill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts