Question: Bond problems (All 4) I need to solve these problems with using BA II Plus calculator or Excel or something simillar. The solving processes are

Bond problems (All 4)

I need to solve these problems with using BA II Plus calculator or Excel or something simillar.

The solving processes are really necessary to me for applying another problems, thanks!

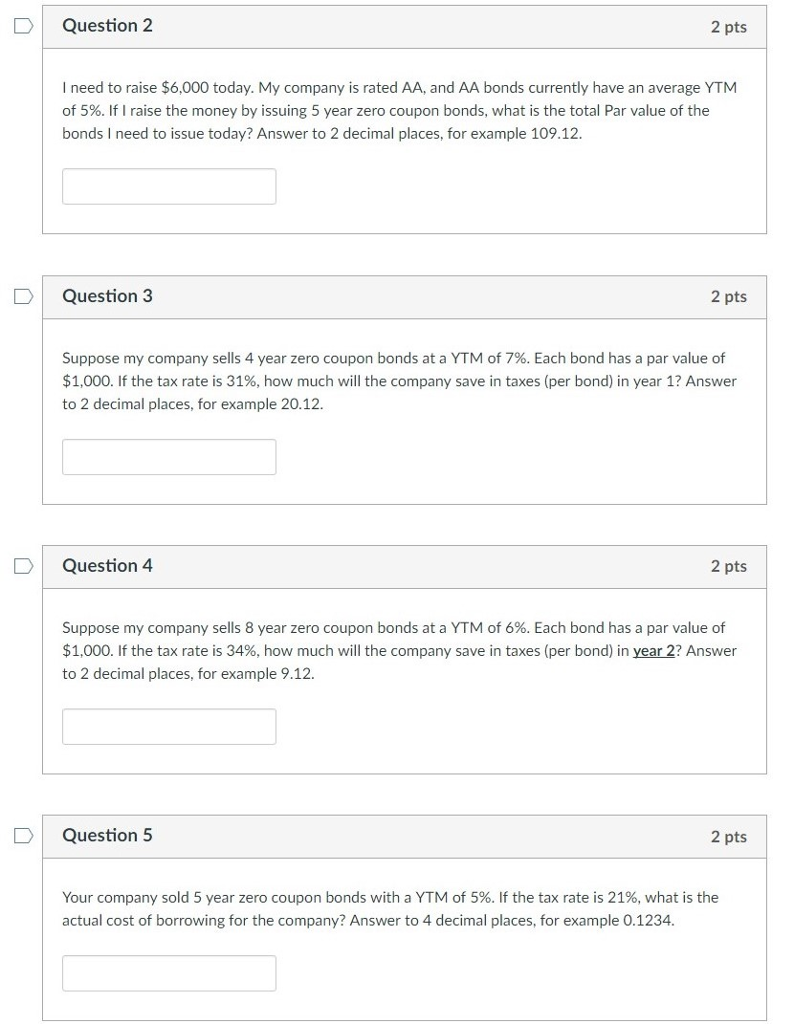

DQuestion 2 2 pts I need to raise $6,000 today. My company is rated AA, and AA bonds currently have an average YTM of 5%. If I raise the money by issuing 5 year zero coupon bonds, what is the total Par value of the bonds I need to issue today? Answer to 2 decimal places, for example 109.12. D Question 3 2 pts suppose my company sells 4 year zero coupon bonds at a YTM of 7%. Each bond has a par value of $1,000. If the tax rate is 31%, how much will the company save in taxes (per bond) in year 1? Answer to 2 decimal places, for example 20.12. D Question 4 2 pts Suppose my company sells 8 year zero coupon bonds at a YTM of 6%. Each bond has a par value of $1,000. If the tax rate is 34%, how much will the company save in taxes (per bond) in year 2? Answer to 2 decimal places, for example 9.12. DQuestion 5 2 pts Your company sold 5 year zero coupon bonds with a YTM of 5%. If the tax rate is 21%, what is the actual cost of borrowing for the company? Answer to 4 decimal places, for example 0.1234

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts