Question: Finance Time Value problems. I need to solve these problems with using N value, I/Y, PV, PMT, and FV (These values are based on the

Finance Time Value problems.

I need to solve these problems with using N value, I/Y, PV, PMT, and FV (These values are based on the BA II Plus calculator).

The solving processes are really necessary to me for applying another problems, thanks!

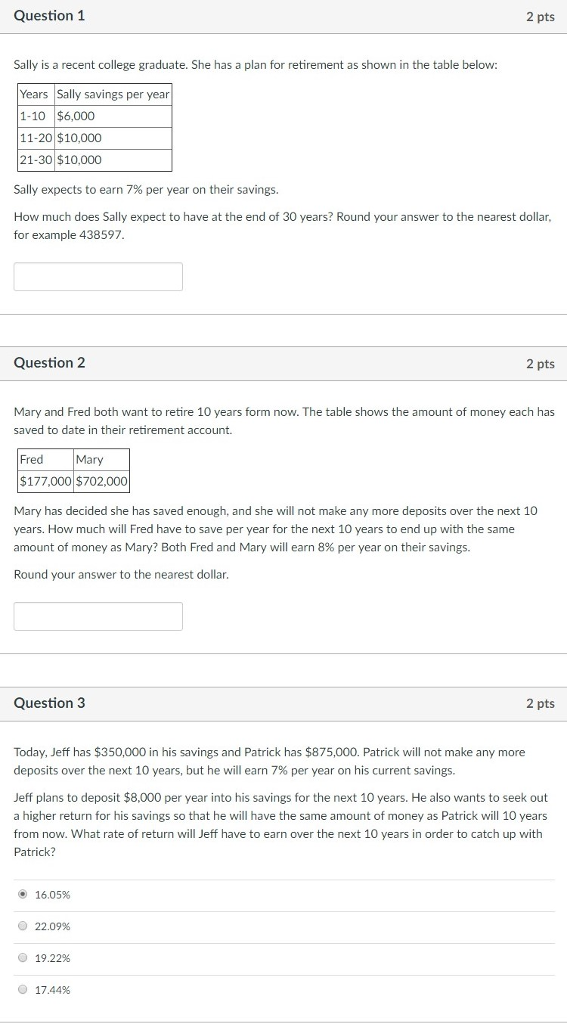

Question 1 2 pts Sally is a recent college graduate. She has a plan for retirement as shown in the table below Years Sally savings per year 1-10 $6,000 11-20 $10,000 21-30 $10,000 Sally expects to earn 7% per year on their savings. How much does Sally expect to have at the end of 30 years? Round your answer to the nearest dollar for example 438597 Question 2 2 pts Mary and Fred both want to retire 10 years form now. The table shows the amount of money each has saved to date in their retirement account. Fred Mary $177,000 $702,000 Mary has decided she has saved enough, and she will not make any more deposits over the next 10 years. How much will Fred have to save per year for the next 10 years to end up with the same amount of money as Mary? Both Fred and Mary will earn 8% per year on their savings. Round your answer to the nearest dollar Question 3 Today, Jeff has $350,000 in his savings and Patrick has $875,000. Patrick will not make any more deposits over the next 10 years, but he will earn 7% per year on his current savings. Jeff plans to deposit $8,000 per year into his savings for the next 10 years. He also wants to seek out a higher return for his savings so that he will have the same amount of money as Patrick will 10 years from now. What rate of return will Jeff have to earn over the next 10 years in order to catch up with Patrick? 16.05% ? 22.09% 19.22% ? 17.44%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts