Question: Bond Return Assignment A 30-year zero-coupon bond yields 8% today and has a face value of $100. The price of such a bond can be

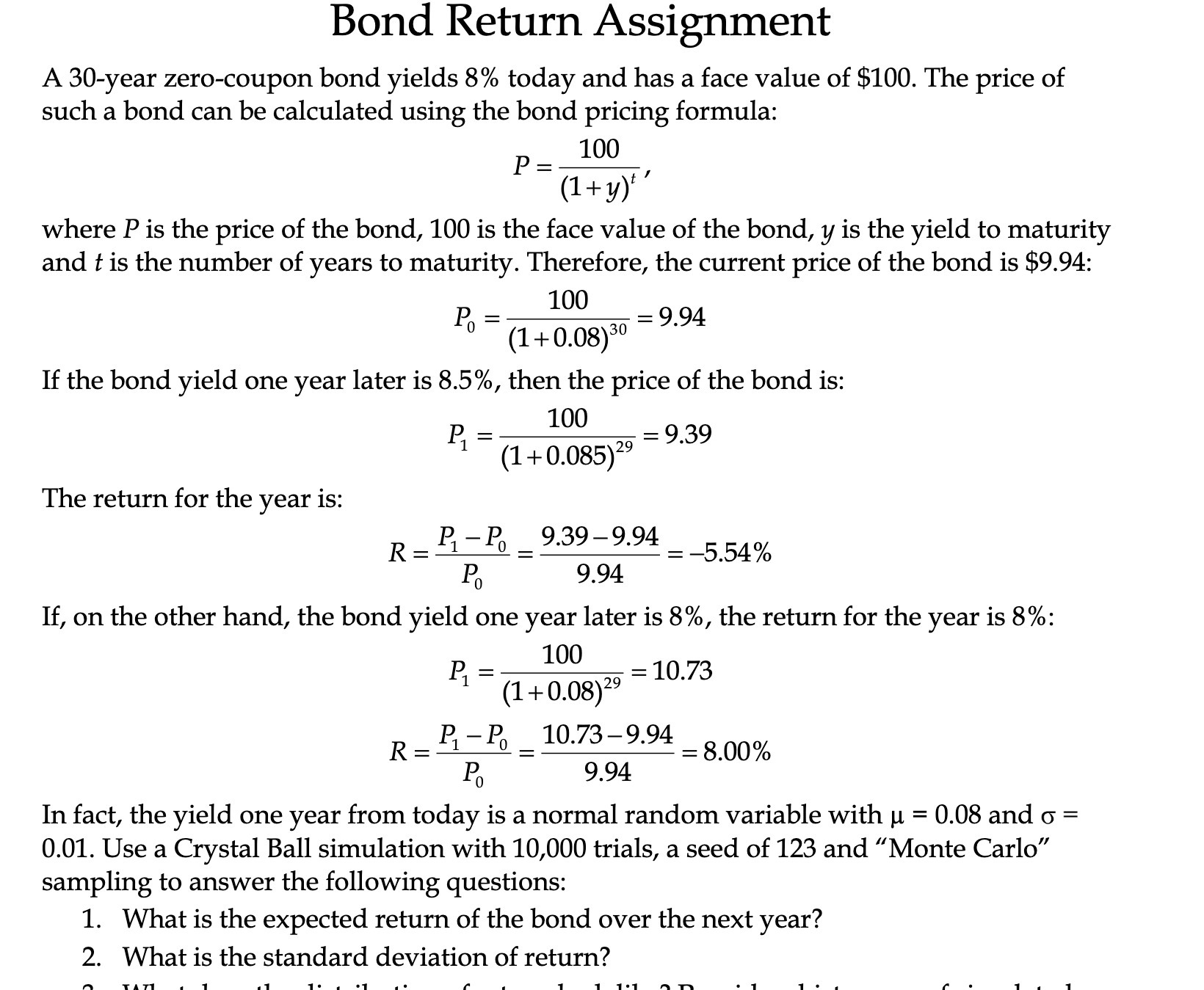

Bond Return Assignment A 30-year zero-coupon bond yields 8% today and has a face value of $100. The price of such a bond can be calculated using the bond pricing formula: = 100 (1+y)' ' where P is the price of the bond, 100 is the face value of the bond, y is the yield to maturity and t is the number of years to maturity. Therefore, the current price of the bond is $9.94: 100 P = = 9.94 0 (1 + 0.08)30 If the bond yield one year later is 8.5%, then the price of the bond is: P1 = $29 = 93,9 (1 + 0.085) The return for the year is: = P1 P0 = 9.399.94 R = 5.54% PO 9.94 If, on the other hand, the bond yield one year later is 8%, the return for the year is 8%: 100 P = = 10.73 1 (1 + 0.08)\" R = P1 P0 = 10.739.94 = 8.00% P0 9.94 In fact, the yield one year from today is a normal random variable with u = 0.08 and o = 0.01. Use a Crystal Ball simulation with 10,000 trials, a seed of 123 and \"Monte Carlo\" sampling to answer the following questions: 1. What is the expected return of the bond over the next year? 2. What is the standard deviation of return? 1111 a 'I :1 'II I "I u f u 1 1 1'1 I!\" ' 1 'I ' n I' ' 1 u 1

Step by Step Solution

There are 3 Steps involved in it

To solve this problem you need to perform a Monte Carlo simulation of the bonds returns based on the given yield distribution Lets break down the step... View full answer

Get step-by-step solutions from verified subject matter experts