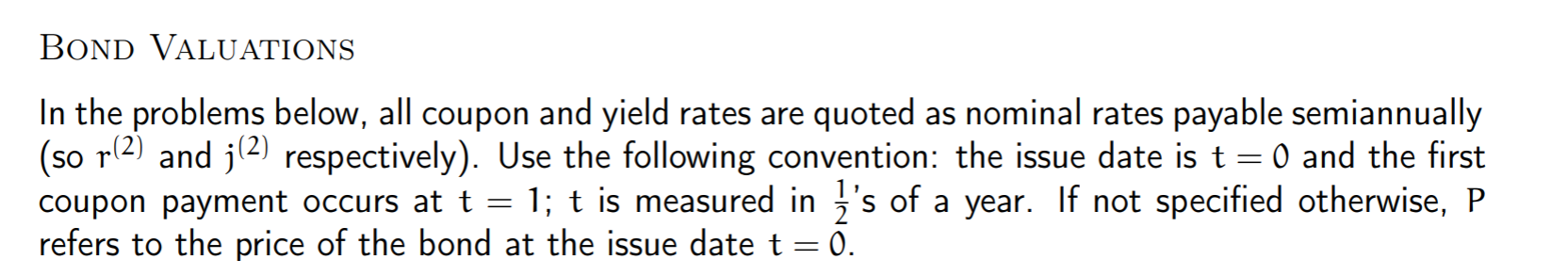

Question: BOND VALUATIONS In the problems below, all coupon and yield rates are quoted as nominal rates payable semiannually (so r(2) and j(2) respectively). Use the

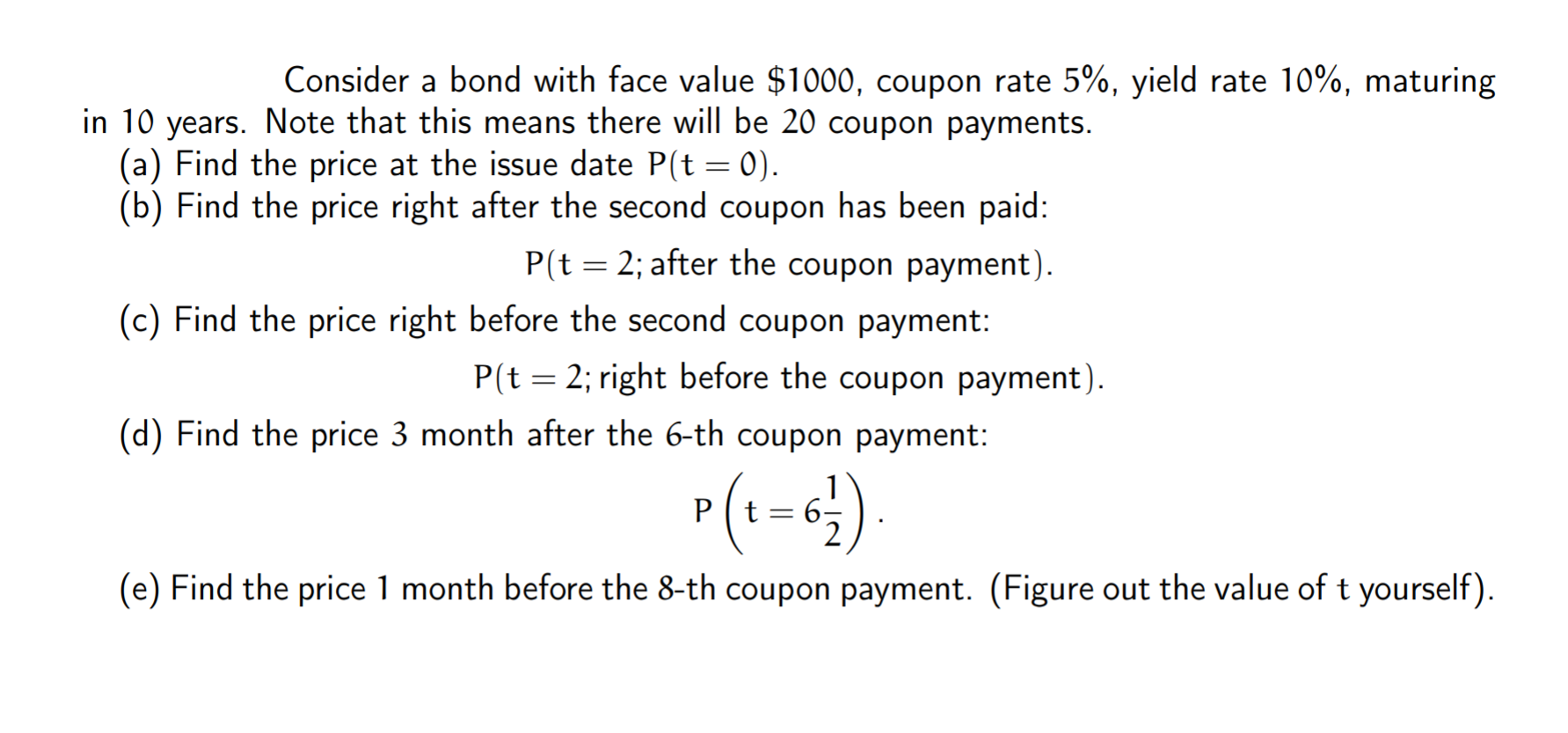

BOND VALUATIONS In the problems below, all coupon and yield rates are quoted as nominal rates payable semiannually (so r(2) and j(2) respectively). Use the following convention: the issue date is t = 0 and the first coupon payment occurs at t 1; t is measured in 1's of a year. If not specified otherwise, P refers to the price of the bond at the issue date t=0. = Consider a bond with face value $1000, coupon rate 5%, yield rate 10%, maturing in 10 years. Note that this means there will be 20 coupon payments. (a) Find the price at the issue date P(t = 0). (b) Find the price right after the second coupon has been paid: P(t = 2; after the coupon payment). (c) Find the price right before the second coupon payment: P(t = 2; right before the coupon payment). (d) Find the price 3 month after the 6-th coupon payment: 1 6 2 (e) Find the price 1 month before the 8-th coupon payment. (Figure out the value of t yourself). = P(t =) = 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts