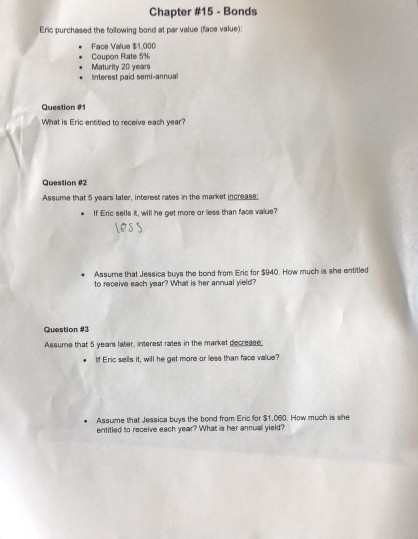

Question: Bond yield problem Chapter #15-Bonds Eric purchased the folowing bond at par value (face value) Face Value $1,000 Coupon Rate 5% Maturity 20 years interest

Bond yield problem

Chapter #15-Bonds Eric purchased the folowing bond at par value (face value) Face Value $1,000 Coupon Rate 5% Maturity 20 years interest paid semi-annual Question 01 What is Eric entitied to receive each year? Question #2 Assume that 5 years later, interest rates in the market increase If Eric sells t, will he get more or less than face value? ess How much is she entitled Assume that Jessica buys the bond from Eric for $940. to receive each year? What is her annual yield? Question #3 Assume that 5 years later, nerest rates in the markat decrease. Eric sels it, will he get more or less than face value? Assume that Jessica buys the bond fram Eric for $1,080. How much is she entitled to receive each year? What is her annual yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts