Question: Bonds and Stocks Valuation Case Dear students, Your assignment for chapter 10 is as follows: ---Bonds The bonds issued by XYZ Inc. have $1,000 Par

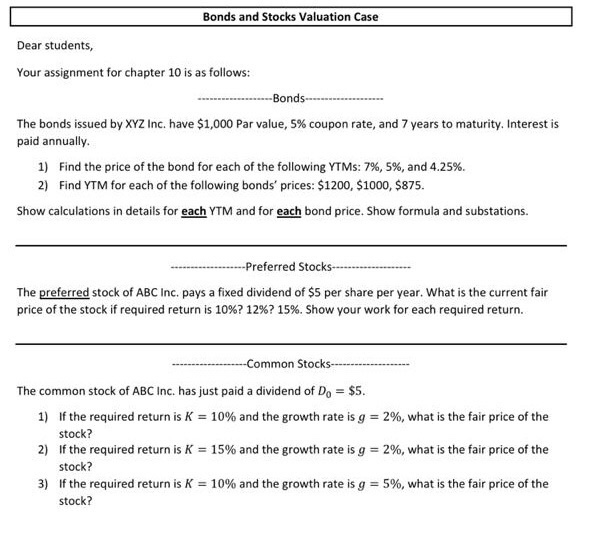

Bonds and Stocks Valuation Case Dear students, Your assignment for chapter 10 is as follows: ---Bonds The bonds issued by XYZ Inc. have $1,000 Par value, 5% coupon rate, and 7 years to maturity. Interest is paid annually. 1) Find the price of the bond for each of the following YTMs: 7%, 5%, and 4.25% 2) Find YTM for each of the following bonds' prices: $1200, $1000, $875. Show calculations in details for each YTM and for each bond price. Show formula and substations. --Preferred Stocks--- The preferred stock of ABC Inc. pays a fixed dividend of $5 per share per year. What is the current fair price of the stock if required return is 10%? 12%? 15%. Show your work for each required return. ------Common Stocks--------------- The common stock of ABC Inc. has just paid a dividend of Do = $5. 1) If the required return is K = 10% and the growth rate is g = 2%, what is the fair price of the stock? 2) If the required return is K = 15% and the growth rate is g = 2%, what is the fair price of the stock? 3) If the required return is K = 10% and the growth rate is g = 5%, what is the fair price of the stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts