Question: Bonds are sensitive to changes in interest rates. The same is true for stocks: their prices tend to decrease when interest rates rise, and they

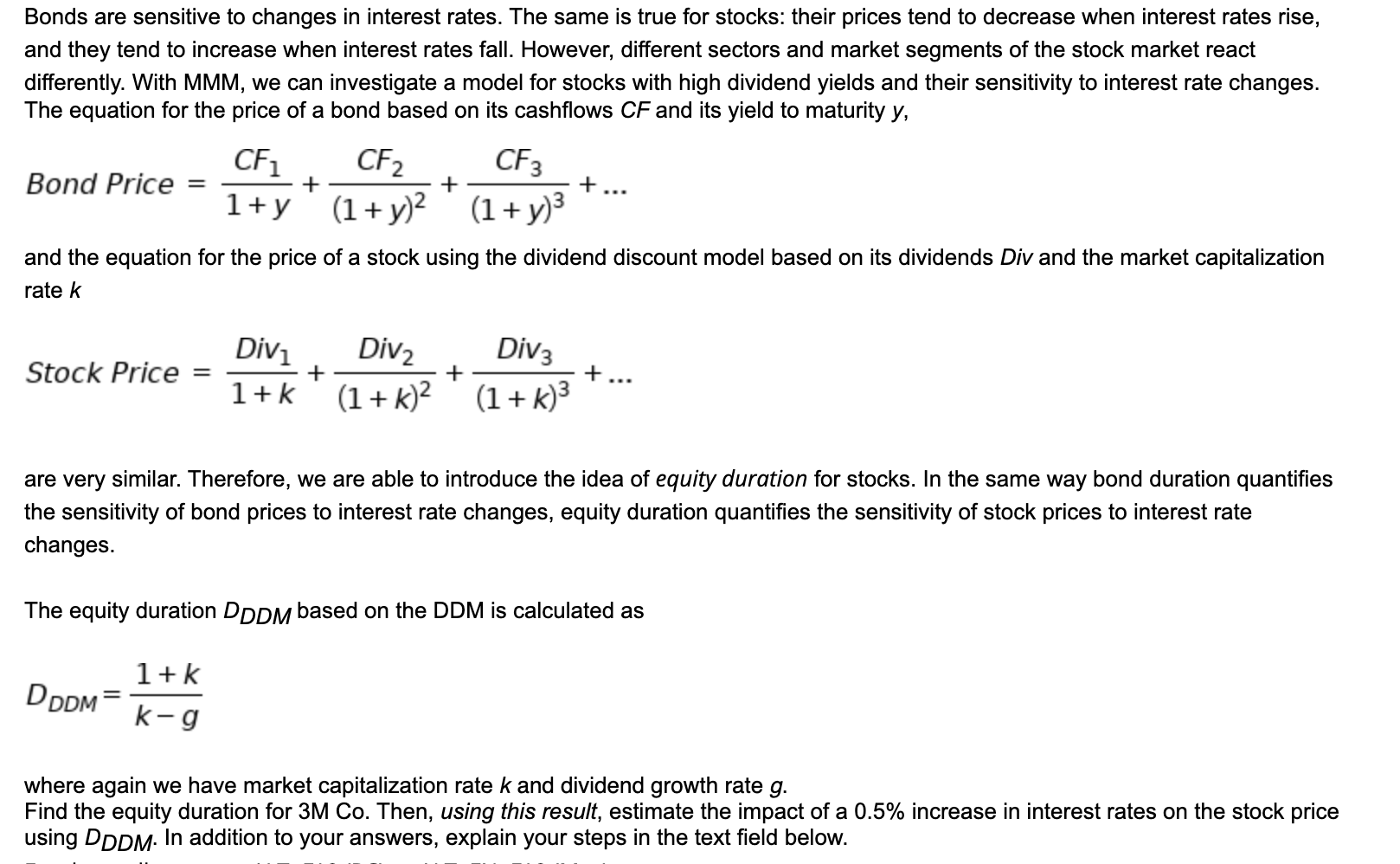

Bonds are sensitive to changes in interest rates. The same is true for stocks: their prices tend to decrease when interest rates rise, and they tend to increase when interest rates fall. However, different sectors and market segments of the stock market react differently. With MMM, we can investigate a model for stocks with high dividend yields and their sensitivity to interest rate changes. The equation for the price of a bond based on its cashflows CF and its yield to maturity y, = + + 1+y CF CF2 CF3 Bond Price + (1 + y)2 (1+y) 3 and the equation for the price of a stock using the dividend discount model based on its dividends Div and the market capitalization rate k Stock Price = Divi Diva Diva + 1+k (1+k)2. (1+k) 3 + + are very similar. Therefore, we are able to introduce the idea of equity duration for stocks. In the same way bond duration quantifies the sensitivity of bond prices to interest rate changes, equity duration quantifies the sensitivity of stock prices to interest rate changes. The equity duration DDDM based on the DDM is calculated as 1+k DDDM = K-9 where again we have market capitalization rate k and dividend growth rate g. Find the equity duration for 3M Co. Then, using this result, estimate the impact of a 0.5% increase in interest rates on the stock price using DDDM. In addition to your answers, explain your steps in the text field below. Bonds are sensitive to changes in interest rates. The same is true for stocks: their prices tend to decrease when interest rates rise, and they tend to increase when interest rates fall. However, different sectors and market segments of the stock market react differently. With MMM, we can investigate a model for stocks with high dividend yields and their sensitivity to interest rate changes. The equation for the price of a bond based on its cashflows CF and its yield to maturity y, = + + 1+y CF CF2 CF3 Bond Price + (1 + y)2 (1+y) 3 and the equation for the price of a stock using the dividend discount model based on its dividends Div and the market capitalization rate k Stock Price = Divi Diva Diva + 1+k (1+k)2. (1+k) 3 + + are very similar. Therefore, we are able to introduce the idea of equity duration for stocks. In the same way bond duration quantifies the sensitivity of bond prices to interest rate changes, equity duration quantifies the sensitivity of stock prices to interest rate changes. The equity duration DDDM based on the DDM is calculated as 1+k DDDM = K-9 where again we have market capitalization rate k and dividend growth rate g. Find the equity duration for 3M Co. Then, using this result, estimate the impact of a 0.5% increase in interest rates on the stock price using DDDM. In addition to your answers, explain your steps in the text field below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts