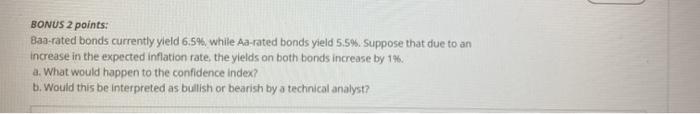

Question: BONUS 2 points: Baa-rated bonds currently yleld 6.5%, while Aa-rated bonds yield 5.5%. Suppose that due to an Increase in the expected inflation rate, the

BONUS 2 points: Baa-rated bonds currently yleld 6.5%, while Aa-rated bonds yield 5.5%. Suppose that due to an Increase in the expected inflation rate, the yields on both bonds increase by 1%. a. What would happen to the confidence index? b. Would this be interpreted as bullish or bearish by a technical analyst

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts