Question: Bonus Problem 2 (Optional, Harder, 45 marks) (a) (10 marks) We consider a bond that pays n coupons at the end of each coupon period.

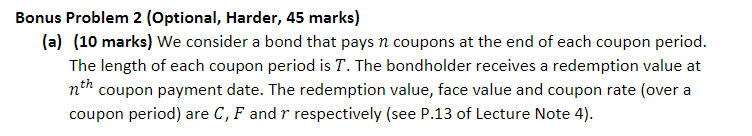

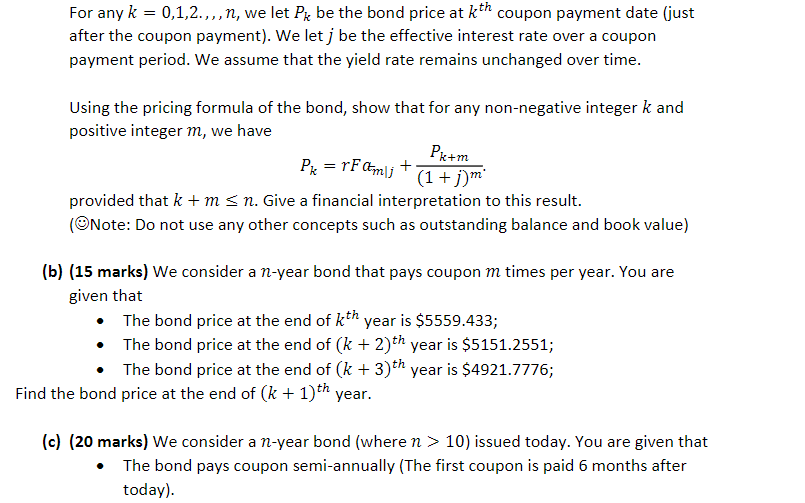

Bonus Problem 2 (Optional, Harder, 45 marks) (a) (10 marks) We consider a bond that pays n coupons at the end of each coupon period. The length of each coupon period is T. The bondholder receives a redemption value at nth coupon payment date. The redemption value, face value and coupon rate (over a coupon period) are C, F and r respectively (see P.13 of Lecture Note 4). For any k = 0,1,2.,,,n, we let Pl be the bond price at kth coupon payment date (just after the coupon payment). We let j be the effective interest rate over a coupon payment period. We assume that the yield rate remains unchanged over time. Using the pricing formula of the bond, show that for any non-negative integer k and positive integer m, we have Pk+m Pk = rFctm|j *(1 + jm provided that k + m sn. Give a financial interpretation to this result. (Note: Do not use any other concepts such as outstanding balance and book value) (b) (15 marks) We consider a n-year bond that pays coupon m times per year. You are given that The bond price at the end of th year is $5559.433; The bond price at the end of (k + 2)th year is $5151.2551; The bond price at the end of (k + 3)th year is $4921.7776; Find the bond price at the end of (k + 1)th year. (c) (20 marks) We consider a n-year bond (where n > 10) issued today. You are given that The bond pays coupon semi-annually (The first coupon is paid 6 months after today). The annual effective yield rate of the bond is 4.8576% and remains unchanged throughout the life of the bond. The book value at the end of 25th month is $3437.6085 The book value at the end of 50th month is $3361.802 Find the book value at the end of 100th month. Bonus Problem 2 (Optional, Harder, 45 marks) (a) (10 marks) We consider a bond that pays n coupons at the end of each coupon period. The length of each coupon period is T. The bondholder receives a redemption value at nth coupon payment date. The redemption value, face value and coupon rate (over a coupon period) are C, F and r respectively (see P.13 of Lecture Note 4). For any k = 0,1,2.,,,n, we let Pl be the bond price at kth coupon payment date (just after the coupon payment). We let j be the effective interest rate over a coupon payment period. We assume that the yield rate remains unchanged over time. Using the pricing formula of the bond, show that for any non-negative integer k and positive integer m, we have Pk+m Pk = rFctm|j *(1 + jm provided that k + m sn. Give a financial interpretation to this result. (Note: Do not use any other concepts such as outstanding balance and book value) (b) (15 marks) We consider a n-year bond that pays coupon m times per year. You are given that The bond price at the end of th year is $5559.433; The bond price at the end of (k + 2)th year is $5151.2551; The bond price at the end of (k + 3)th year is $4921.7776; Find the bond price at the end of (k + 1)th year. (c) (20 marks) We consider a n-year bond (where n > 10) issued today. You are given that The bond pays coupon semi-annually (The first coupon is paid 6 months after today). The annual effective yield rate of the bond is 4.8576% and remains unchanged throughout the life of the bond. The book value at the end of 25th month is $3437.6085 The book value at the end of 50th month is $3361.802 Find the book value at the end of 100th month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts