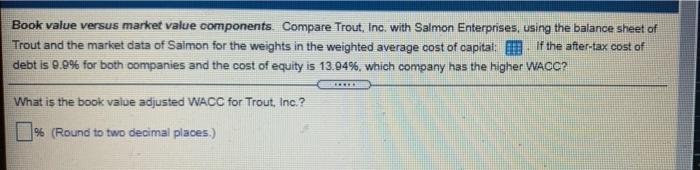

Question: Book value versus market value components. Compare Trout, Inc. with Salmon Enterprises, using the balance sheet of Trout and the market data of Saimon for

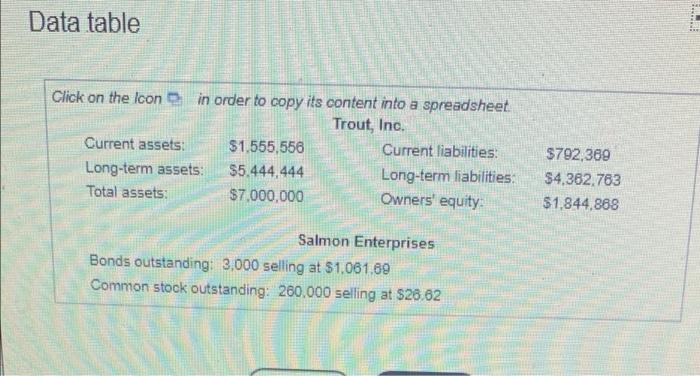

Book value versus market value components. Compare Trout, Inc. with Salmon Enterprises, using the balance sheet of Trout and the market data of Saimon for the weights in the weighted average cost of capitat: M. if the after-tax cost of debt is 0.0% for both companies and the cost of equity is 13.94%, which company has the higher WACC? What is the book value adjusted WACC for Trout, Inc.? % (Round to two decimal places.) .. Data table Click on the Icon in order to copy its content into a spreadsheet Trout, Inc. Current assets $1.555,556 Current liabilities: Long-term assets: $5.444.444 Long-term liabilities: Total assets: $7,000,000 Owners' equity $792,369 $4,362.763 $1.844.868 Salmon Enterprises Bonds outstanding: 3,000 selling at $1.061.69 Common stock outstanding: 260.000 selling at $26.62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts