Question: Bookmarks Profiles Tab Window Help M 20% D le 8: Learning Activities: X + au/courses/1806088/pages/module-8-learning-activities 04 Update News VEILLUT MSsignmen 1. Two firms U and

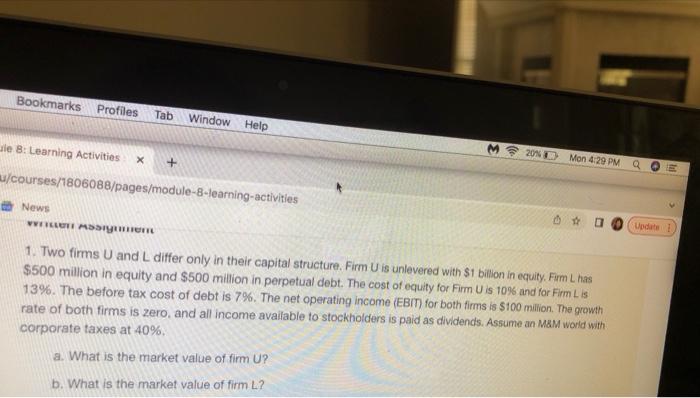

Bookmarks Profiles Tab Window Help M 20% D le 8: Learning Activities: X + au/courses/1806088/pages/module-8-learning-activities 04 Update News VEILLUT MSsignmen 1. Two firms U and L differ only in their capital structure. Firm U is unlevered with $1 billion in equity. Firm L has $500 million in equity and $500 million in perpetual debt. The cost of equity for Firm U is 10% and for Firm L is 13%. The before tax cost of debt is 7%. The net operating income (EBIT) for both firms is $100 million. The growth rate of both firms is zero, and all income available to stockholders is paid as dividends. Assume an M&M world with corporate taxes at 40%. a. What is the market value of firm U? b. What is the market value of firm L? Mon 4:29 PM Q O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts