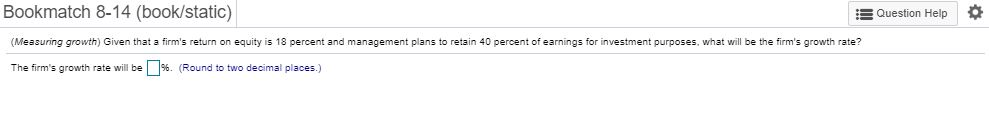

Question: Bookmatch 8-14 (book/static) Question Help (Measuring growth) Given that a firm's return on equity is 18 percent and management plans to retain 40 percent of

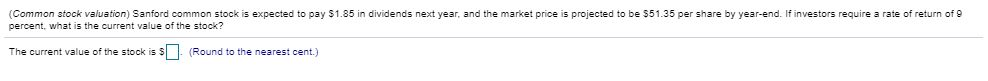

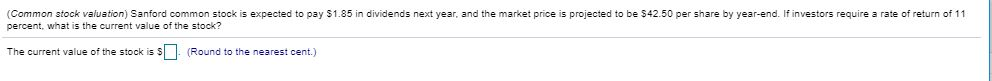

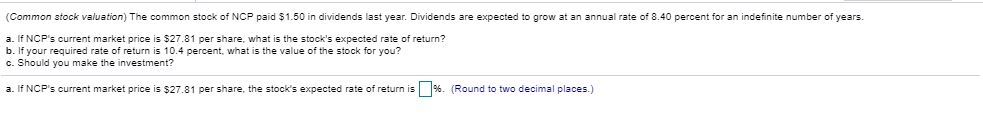

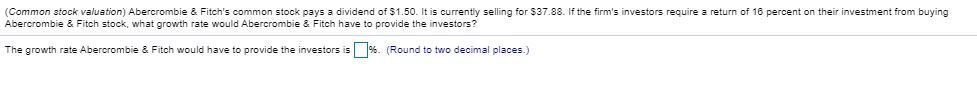

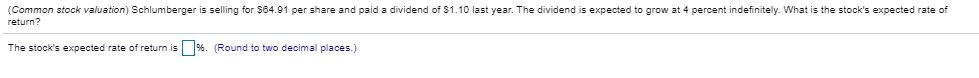

Bookmatch 8-14 (book/static) Question Help (Measuring growth) Given that a firm's return on equity is 18 percent and management plans to retain 40 percent of earnings for investment purposes, what will be the firm's growth rate? The firm's growth rate will be 96. (Round to two decimal places.) (Common stock valuation) Sanford common stock is expected to pay $1.85 in dividends next year, and the market price is projected to be $51.35 per share by year-end. If investors require a rate of return of 9 percent, what is the current value of the stock? The current value of the stock is 5 (Round to the nearest cent.) (Common stock valuation) Sanford common stock is expected to pay $1.85 in dividends next year, and the market price is projected to be $42.50 per share by year-end. If investors require a rate of return of 11 percent, what is the current value of the stock? The current value of the stock is (Round to the nearest cent.) (Common stock valuation) The common stock of NCP paid $1.50 in dividends last year. Dividends are expected to grow at an annual rate of 8.40 percent for an indefinite number of years. a. If NCP's current market price is $27.81 per share, what is the stock's expected rate of return? b. If your required rate of return is 10.4 percent, what is the value of the stock for you? c. Should you make the investment? a. If NCP's current market price is $27.81 per share the stock's expected rate of return is %. (Round to two decimal places.) (Common stock valuation) Abercrombie & Fitch's common stock pays a dividend of $1.50. It is currently selling for $37.88. If the firm's investors require a return of 16 percent on their investment from buying Abercrombie & Fitch stock, what growth rate would Abercrombie & Fitch have to provide the investors? The growth rate Abercrombie & Fitch would have to provide the investors is 96. (Round to two decimal places.) (Common stock valuation) Schlumberger is selling for $64.91 per share and paid a dividend of $1.10 last year. The dividend is expected to grow at 4 percent indefinitely. What is the stock's expected rate of return? The stock's expected rate of return is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts