Question: Boomer Enterprises is analyzing a potential project known as Project Zap! which has a 3 year life. Project Zap! has the following expected FCFs :

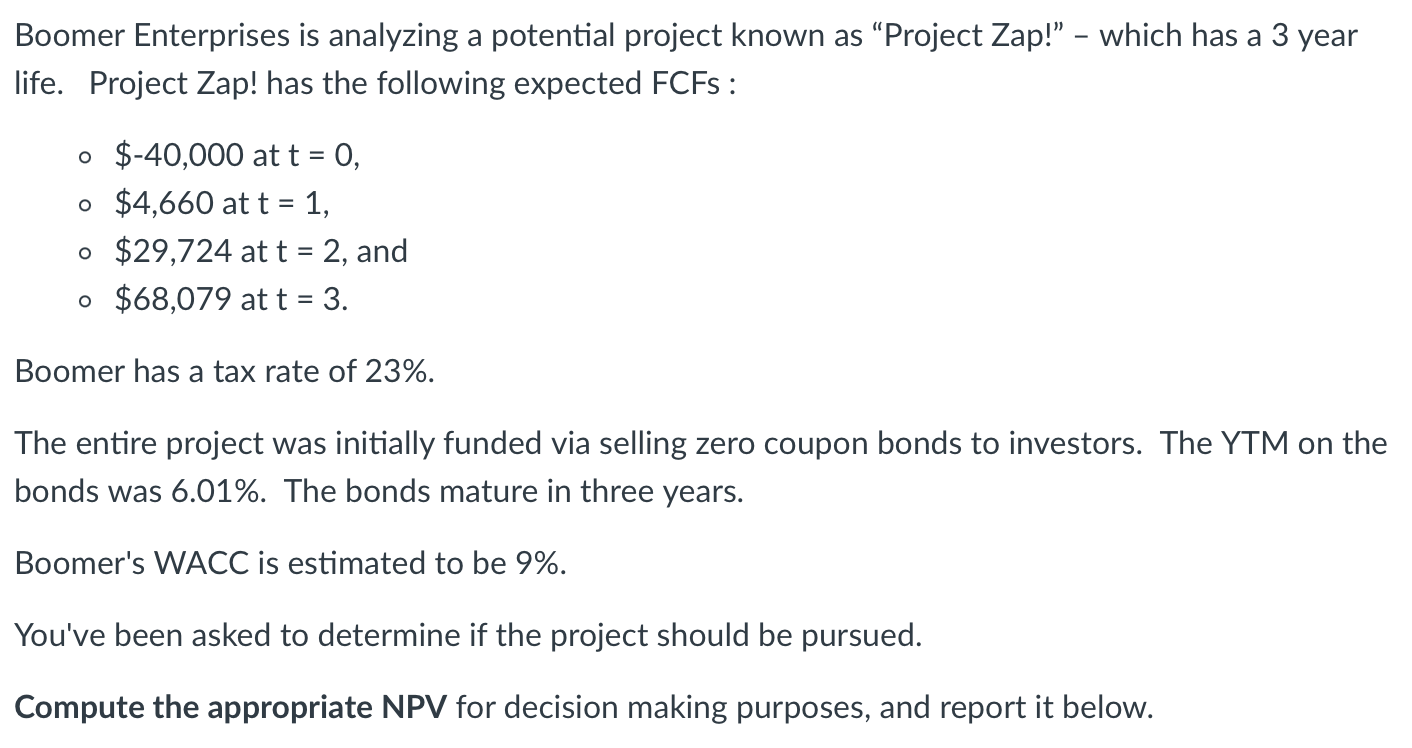

Boomer Enterprises is analyzing a potential project known as Project Zap! which has a 3 year life. Project Zap! has the following expected FCFs : = o $-40,000 at t = 0, o $4,660 at t = 1, o $29,724 at t = 2, and o $68,079 at t = 3. = Boomer has a tax rate of 23%. The entire project was initially funded via selling zero coupon bonds to investors. The YTM on the bonds was 6.01%. The bonds mature in three years. Boomer's WACC is estimated to be 9%. You've been asked to determine if the project should be pursued. Compute the appropriate NPV for decision making purposes, and report it below

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock