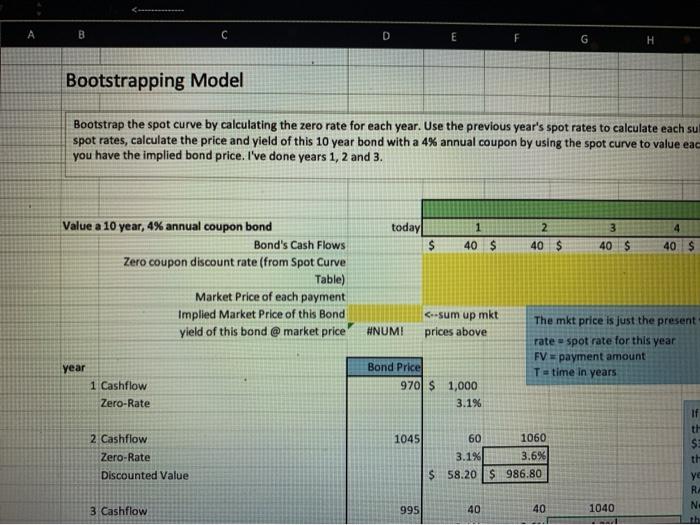

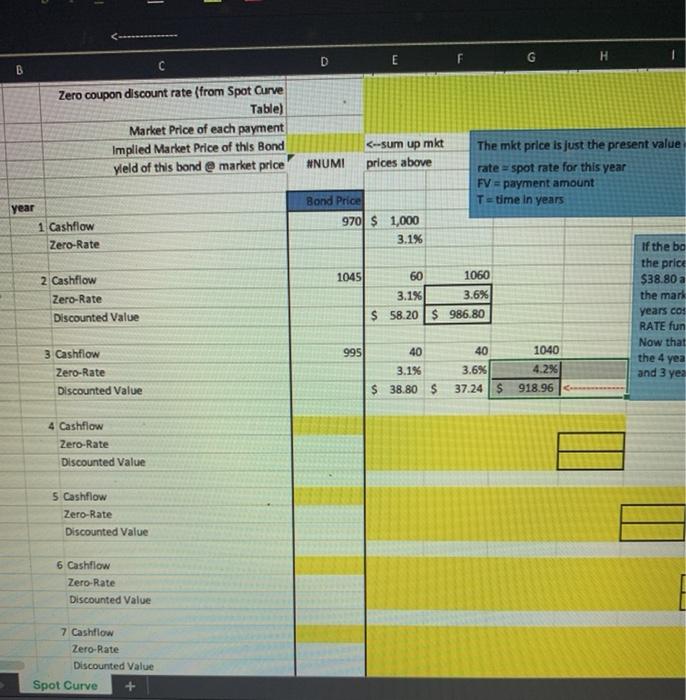

Question: bootstrapping model help in excel with formulas please! B C D E F G H Bootstrapping Model Bootstrap the spot curve by calculating the zero

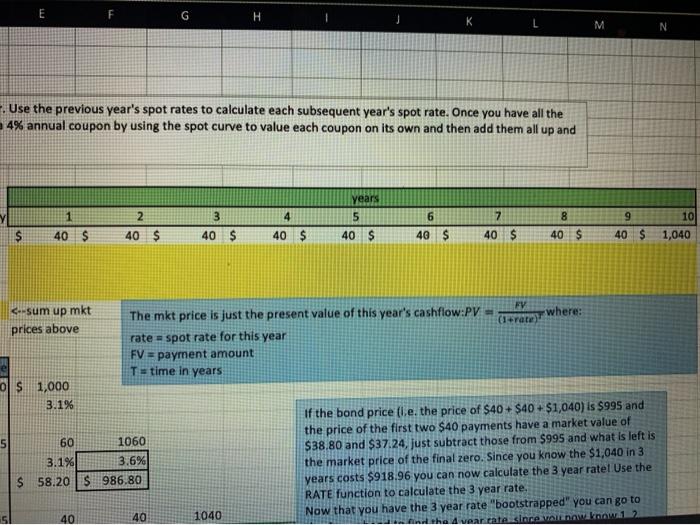

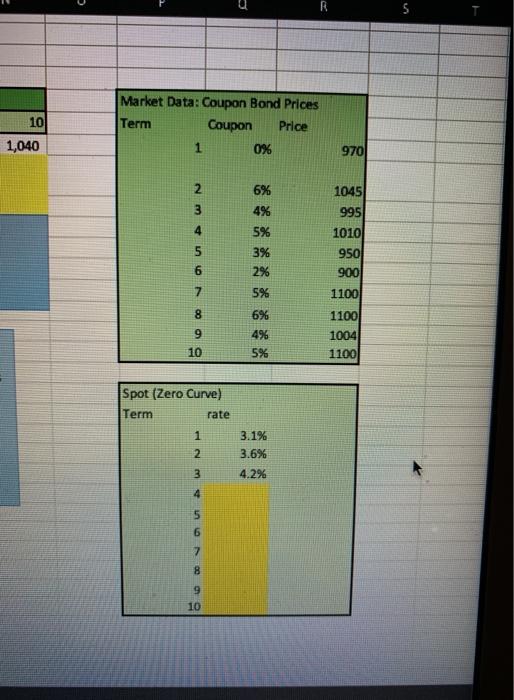

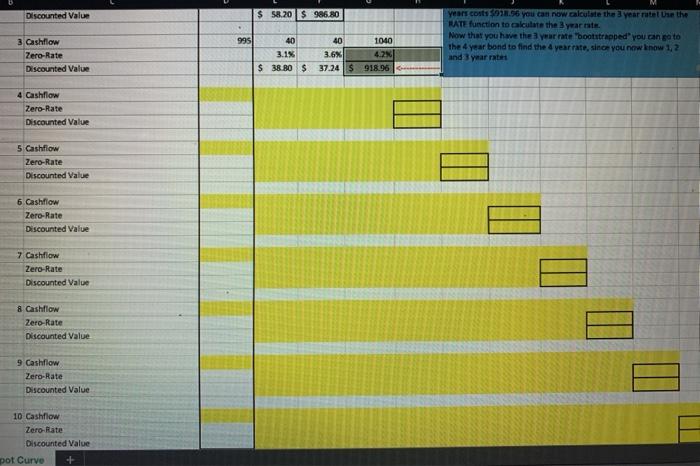

B C D E F G H Bootstrapping Model Bootstrap the spot curve by calculating the zero rate for each year. Use the previous year's spot rates to calculate each su spot rates, calculate the price and yield of this 10 year bond with a 4% annual coupon by using the spot curve to value eac you have the implied bond price. I've done years 1, 2 and 3. today 1 40 $ 2 40 $ 3 40 $ $ 40 $ Value a 10 year, 4% annual coupon bond Bond's Cash Flows Zero coupon discount rate (from Spot Curve Table) Market Price of each payment Implied Market Price of this Bond yield of this bond @ market price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts