Question: Both 1 & 2 please 1. Complete the beginning of the year balance and end of the year balance sheet for a mutual fund with

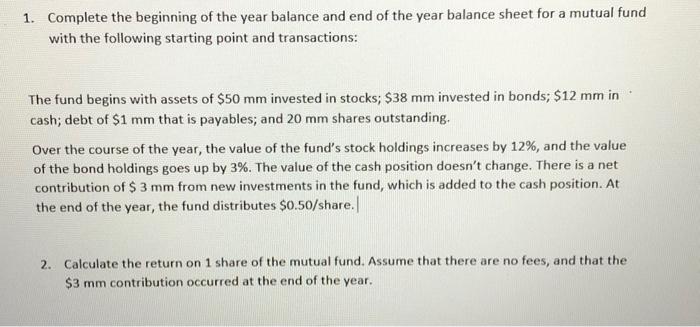

1. Complete the beginning of the year balance and end of the year balance sheet for a mutual fund with the following starting point and transactions: The fund begins with assets of $50 mm invested in stocks; $38 mm invested in bonds; $12 mm in cash; debt of $1 mm that is payables; and 20 mm shares outstanding. Over the course of the year, the value of the fund's stock holdings increases by 12%, and the value of the bond holdings goes up by 3%. The value of the cash position doesn't change. There is a net contribution of $ 3 mm from new investments in the fund, which is added to the cash position. At the end of the year, the fund distributes $0.50/share. 2. Calculate the return on 1 share of the mutual fund. Assume that there are no fees, and that the $3 mm contribution occurred at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts