Question: Both advanced and developing countries have experienced a decrease in inflation since the 1980s (see Table 3-3 in the text). This question considers how the

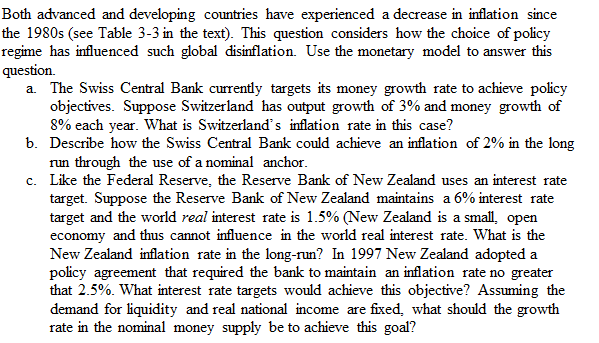

Both advanced and developing countries have experienced a decrease in inflation since the 1980s (see Table 3-3 in the text). This question considers how the choice of policy regime has influenced such global disinflation. Use the monetary model to answer this question. The Swiss Central Bank currently targets its money growth of 8% each year. What is Switzerland has output growth of 3% and money growth of 8% each year. What is Switzerland's inflation rate in this case? Describe how the Swiss Central Bank could achieve an inflation of 2% in the long run through the use of a nominal anchor. Like the Federal Reserve, the Reserve Bank of New Zealand uses an interest rate target and the world real interest rate is 1.5% (New Zealand is a small, open economy and thus cannot influence in the world real interest rate. What is the New Zealand inflation rate in the long-run? In 1997 New Zealand adopted a policy agreement that required the bank to maintain an inflation rate no greater that 2.5%. What interest rate targets would achieve this objective? Assuming the demand for liquidity and real national income are fixed, what should the growth rate in the nominal money supply to be achieve this goal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts