Question: both drop down options are euros and dollars STEP: 1 of 3 Suppose that Nevada Co., a US-based MNC, makes regular, monthly purchases of materials

both drop down options are euros and dollars

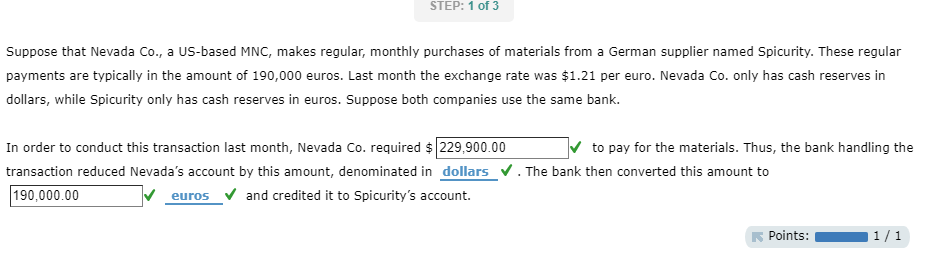

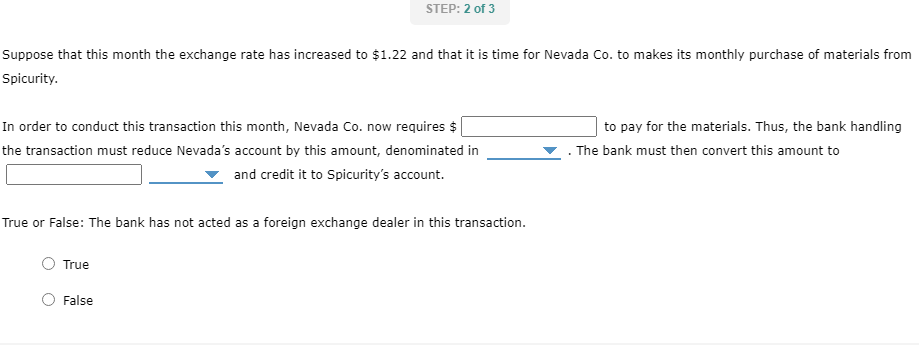

STEP: 1 of 3 Suppose that Nevada Co., a US-based MNC, makes regular, monthly purchases of materials from a German supplier named Spicurity. These regular payments are typically in the amount of 190,000 euros. Last month the exchange rate was $1.21 per euro. Nevada Co. only has cash reserves in dollars, while Spicurity only has cash reserves in euros. Suppose both companies use the same bank. In order to conduct this transaction last month, Nevada Co. required $ 229,900.00 to pay for the materials. Thus, the bank handling the transaction reduced Nevada's account by this amount, denominated in dollars. The bank then converted this amount to 190,000.00 euros and credited it to Spicurity's account. Points: 1/1 STEP: 2 of 3 Suppose that this month the exchange rate has increased to $1.22 and that it is time for Nevada Co. to makes its monthly purchase of materials from Spicurity. In order to conduct this transaction this month, Nevada Co. now requires $ the transaction must reduce Nevada's account by this amount, denominated in and credit it to Spicurity's account. to pay for the materials. Thus, the bank handling . The bank must then convert this amount to True or False: The bank has not acted as a foreign exchange dealer in this transaction. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts